[ad_1]

After almost a year of bearishness. Indeed, everyone is still panicking, banks are close to filing for insolvency, and the world economy is on the edge of collapsing. Why do I still think Bitcoin is Bullish? Hear me out…

Bitcoin VS Traditional Market(S&P 500, Nasdaq)

The Fed keeps on increasing interest rates consistently. The higher it goes, the more the market panic and crashes. The traditional markets keep on breaking support levels one after the other, making a lower low from the previous low.

I am not an expert in technical analysis, but it is not rocket science to see that the S&P 500 chart shows weakness! Although breaking through the support line and bouncing back above it signals a fake-out, we cannot ignore the fact that this recent low is a lower low, which signals a continuation of the downtrend.

As for the Nasdaq, it looks better than the S&P chart since it didn’t break through the support level yet, but it still made a lower low, which shows there is a continuation of the downtrend. As the interest rate and the DXY(dollar index) keeps on increasing, these markets will most likely continue crashing to the downside.

On the other hand, Bitcoin is supposed to be closely correlated to the traditional markets(etc. S&P 500, Nasdaq), showing something different.

We can conclude 2 things from the BTC chart above, it held the major support level, and also it made a HIGHER LOW. That means so far, out of the charts above, BTC is the only one that tries to break the downward trend, unlike the more mature markets. This shows significant investors’ confidence.

Smart money vs Dumb money

According to Investopedia, smart money can be defined as

‘the capital that is being controlled by institutional investors, market mavens, central banks, funds, and other financial professionals.’

In other words, they are successful and experienced investors. On the other hand, Dumb money can simply mean less experienced, retail investors.

Smart money is the blue line and dumb money is the brown line, the chart above that is published by gameoftrades indicated what other people are doing. Smart money buys are starting to increase and dumb money is doing the opposite. There is a massive divergence. What we can conclude from this is the experienced investors are starting to get confidence in the market, while the less experienced investors are starting to panic. Last weekend people Panicked as the Bitcoin fear and greed index dived to 20. Over these 2 groups of people, who do you think it will be wiser to follow?

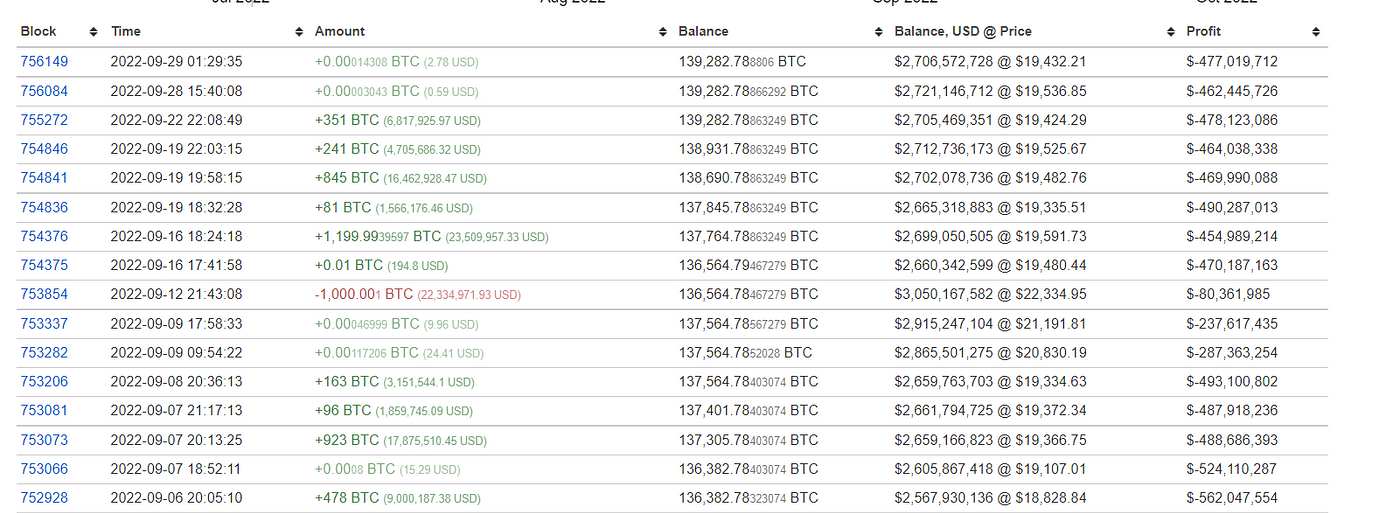

This Bitcoin whale keeps on adding Bitcoin to his wallet. We can see more and more big investors getting into crypto. We need to ask ourselves, do the big investors know something we don’t know? Maybe, and just maybe… the bottom is in?

As Warren Buffet said, the stock market is a device for transferring money from the impatient to the patient.” Even though Bitcoin and other asset prices are crashing, learn about the asset you are investing in and give the team time to solve all their problems. If you made the right bet, you will come out winning!

The New Narrative

After the pandemic, the world economy is basically a mess. Countries started to print insane amounts of money to combat the economic breakdown. This caused asset prices and inflation numbers to skyrocket. It has to come to an end at some point. In late 2021, the fed started to increase interest rates to reduce the money supply in the economy, in hopes to combat the sky-high inflation rate. As a result, the dollar index started rising and asset prices started to crash. This has been the narrative that drives fear in the market… until now…

I am sure many of us are the victims of the Luna, Celsius, and another financial institution collapse. Shortly after the crypto market collapsed, a lot of crypto companies followed. Talking about it triggers ‘PTSD’! However, that is just the tip of the iceberg. Recently, there are rumors that some of the biggest banks are in the blink of collapsing. According to Bloomberg, a Switzerland bank, Credit Suisse Group is at a critical moment. But don’t panic yet, the bank is still financially ‘okay’. However, if this rumor starts to escalate, and people start to panic, and start withdrawing all their money from the bank, this can cause a bank run and this can cause the bank to collapse.

This is serious, and Credit Suisse Group is not the only bank. According to ZeroHedge, 8 G-SIBs’ price-to-book ratio is flashing warning signs. G-SIB, according to Wikipedia, refers to banks that can be called the systematically important financial institution.

According to Graham Stephan, during the 2008 financial crisis, what the Lehman Brothers controlled is 600 billion dollars. The collapse of Lehman Brothers brought the world down. Right now, Credit Suisse Group and Deutsche Bank control more than 2800 billion dollars worth of assets. I can’t think of a more disastrous scenario than this. The world’s fate is in the hands of the banks. But why do I still think Bitcoin is bullish?

In this economy, people are losing their fate in government. The inflation rate keeps on increasing. Banks and cash that were preached to be the safe haven for people are collapsing too. People will want to put their money into something liquid and safe enough. Bitcoin, on the other hand, is liquid, safe, and also not controlled by financial institutions, which can be a good alternative. This can be a good narrative for Bitcoin to gain more attention.

Conclusion

I am not saying that Bitcoin can skyrocket right after the banks collapsed, but I think Bitcoin will have a good chance to outstand centralized entities as people start to lose trust in the current financial system. Bitcoin is designed as an inflation hedge and also designed to revolutionize the current financial system. Amid all the financial instability, as people start to move towards this alternative, they will start to realize all these benefits, and subsequently, start to understand the crypto market as a whole.

New to trading? Try crypto trading bots or copy trading

[ad_2]

Source link