[ad_1]

There are said to be two certainties in life that you can always count on. They are taxes and death. No matter how hard you try, they are inevitable and will eventually catch up with you. The cryptocurrency market is just over 10 years old, but it is becoming more evident by the year that it too has its own certainties that you can count on. In its short history, recently on almost a yearly basis, it seems that crypto has a new “big thing.” Something that is incredibly hyped that not only causes a frenzy of people rushing back into crypto but causes prices overall to increase. In 2017/18 there was the ICO movement. In 2020, there was DeFi summer. In 2021 we saw multiple hyped movements, meme coins, and NFTs.

Many of us who have been in the crypto market for quite some time now have learned one important thing. It is always important to be open-minded and be looking out on the horizon for the next big thing. The signs are usually there, but they are just hidden better during bear markets. I remember when Crypto Punks and BAYC could be had for just a few ETH upon release. Those who study the market constantly, and brainstorm where the market may be heading are often the ones who have the most success. Often times when these hype cycles come and people begin rushing into those markets. Unfortunately, most of the money has been made and it is already too late. That is why it is so important to get to the destination before everyone else starts buying their tickets.

If you missed out on those opportunities, there is no need to worry about it. I missed out on most of those too. As I mentioned before, one of the certainties with crypto is that there will be a next big thing. So even if you missed out on past opportunities, it is important to keep our minds focused, and our eyes open so that we can spot the next one.

What could be the next big thing? I’ll be honest with you and tell you that I don’t know. No one really does for sure. However, I do have a few ideas of some things that could take off during the next few years. Who knows, one of them just might end up being the next big thing in crypto.

1. Gaming

I believe that one of the most obvious answers for what could be the next big thing in crypto is gaming. In fact, we have already had a glimpse of this with Axie Infinity. Something that was the talk of the market for about a month and actually is still really popular in some places like the Philippines. Where people are legitimately playing this game as their full-time job. The key point to remember is that the gaming market is huge. It is the biggest entertainment industry out there. Even bigger than movies and TV. Nearly everyone would probably agree that the crypto games that have been released so far are less concerned about the actual game and fun factor. But instead, they focused more on the crypto earning factor. When “real” games are high quality, focusing on the gameplay first, and then also have crypto-earning features available. That is the moment that this market is going to take off.

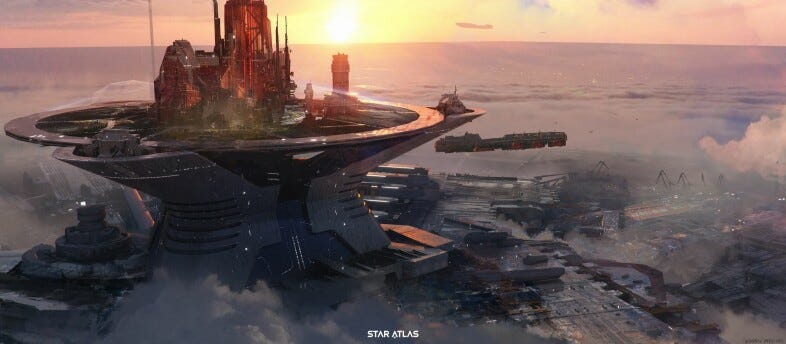

This is a picture from Star Atlas, a game that is in development that is being built on the Solana blockchain. While this game could be years away from being released. This is the type of experience that will bring in the masses. The hype will be real, and one of these projects will become huge. Many large video game companies are seeing this future trend too. Square Enix, which is the game company behind Final Fantasy, has been very vocal about its interest in future blockchain gaming. Also, just last week, Sega, announced that they would be making a blockchain video game.

2. ENS

I’ve learned over the years that I need to do a much better job keeping an open mind for what might become the next big thing. For example, one of the trends that I had many opportunities for from the beginning, but decided to ignore were NFTs. I had several chances to acquire Crypto Punks and also Bored Ape Yacht Club NFTs. Instead, I wasn’t interested and decided to ignore them until they became incredibly valuable. ENS, (Ethereum Name Service) could also be one of the next big things. ENS is a Blockchain domain naming protocol built specifically for the Ethereum Blockchain. Using it allows customers to create human-friendly and readable usernames for their Ethereum-based crypto wallet, and decentralized websites and apps. Part of the reason that helped NFTs take off in popularity was how the supply of many of them was. Often sets had a limited amount of NFTs minted, and some were even only 1 of 1. It became a status symbol. The ability to show off that you owned something incredibly limited helped that market take off. That could happen with ENS as well. For example, ENS domains that were only 3 or 4 digits long have already skyrocketed in value. A trend that will definitely continue in the future. Also if web 3.0 on Ethereum would take off in popularity, everyone will be wanting or need ENS addresses. Domain squatters will come and the value of the market could go up.

3. Layer 2’s and The Return of DeFi Summer

Like it or not, but recently a high percentage of the biggest trends have begun on the Ethereum blockchain. Trends such as ICOs, DeFi, NFTs, and others. During the summer of 2020, DeFi on Ethereum surged in popularity and the period was nicknamed, DeFi Summer. Some would even argue that this was one of the catalysts to the bull market beginning. However, as DeFi took off in popularity, Ethereum fees would also skyrocket upwards. This would eventually cause fees to become so expensive that most people were locked out of using DeFi. This would cause the DeFi market to go into a deep sleep, even while the rest of the market was pumping during the bull market.

That could be changing very soon. Layer 2’s on Ethereum have come along very well and will continue to improve even further. Naturally, by using these Layer 2’s, fees become much cheaper. Which once again opens up the Ethereum ecosystem to regular users. Other blockchains like Solana, Avalanche, Near, and others found popularity because they were so much cheaper to transact on than Ethereum. But, there is no denying that Ethereum is still the king of smart contract blockchains. This could cause a rush back into these markets and will revive the DeFi market.

Another point going in this favor is all of the CeFi chaos that has taken place this year. Companies like Celsius, Vauld, and Voyager became insolvent and users’ funds were frozen on them. This has made DeFi look much more appealing. Although DeFi doesn’t come without risks. Hacks have become commonplace in the industry and users should use extreme caution. If the Ethereum Layer 2 landscape takes off in popularity, it has the potential to render a high percentage of other smart-contract chains useless.

4. Metaverse’s

We already saw a sneak peek of Metaverse projects soaring in popularity once Facebook changed its name to Meta and detailed its plans to focus on building a metaverse in late 2021. But in my opinion, we have even glimpsed a small percentage of the potential market that metaverses could present. Metaverses are an extremely long play and could take years, and even decades to come to fruition. There is also the potential that they will never fully be released or deliver on the hype. But if they do, this is a market that we need to be invested in. Everything in your life could be done in these metaverses in the future. Your job, school, entertainment, games, concerts, sporting events, movies, conferences, social interactions, dating. Anything. Then taking into account that NFTs will be heavily incorporated and that is another reason that could help propel this market’s popularity. The market is a gamble, and may never fully deliver on its ambitious promises.

5. Bitcoin

Some might be surprised by this choice. How could Bitcoin be the next big thing when it is already the number one coin? All you need to do is look at the world around you. The world is going through difficult times and probably will only continue to become worse. Governments are deeply in debt and trying to inflate their way out of this debt. All the while, the money that we have worked so hard to earn is being devalued. There is a strong likelihood that in the near future, the US dollar will no longer be the world reserve currency. If that were to happen, we need to begin thinking about what currency could replace it. Some will say China’s Yuan. But the world most likely wouldn’t trust a currency that is controlled by a dictator. After that, going through the list of currencies quickly shows that there aren’t any good options. Options where every country could be satisfied and trust the currency. That is when Bitcoin comes into play. Bitcoin itself could become the world reserve currency or a currency that is backed by Bitcoin. Naturally, this would cause shockwaves across the market.

With all of that said, Bitcoin doesn’t need to become the world reserve currency to become the next big thing. More and more people are waking up to what makes Bitcoin so great. The immutability, being trustless, uncensorable, and allowing you to truly own your own asset. Then add the fact that inflation on Bitcoin is lower and will only continue to decrease. Making Bitcoin perhaps the strongest currency that you can own. One of the few assets that actually rewards you for saving, rather than punishing you. More and more people will begin choosing to put their savings into Bitcoin and the price will continue to go up.

At the end of the day, each one of these could be the next big thing. There is also the possibility that none of them could be. It is a certainty that there will be new developments or features in the cryptocurrency market in the near future that will cause a frenzy and bring retail buyers back into the market. The only question is what that will be.

How about you? What do you think the next big thing in crypto will be?

As always, thank you for reading!

New to trading? Try crypto trading bots or copy trading

[ad_2]

Source link