[ad_1]

A Philosophical Homage to the Socratic Method

0xFishylosopher

This article is a “vertical” introduction to Web3 that discusses the industry using three ideological pillars. For a “horizontal” introduction of how generations of Web3 projects have grown over time, see my sister article “A Family Portrait of Web3”

Introduction

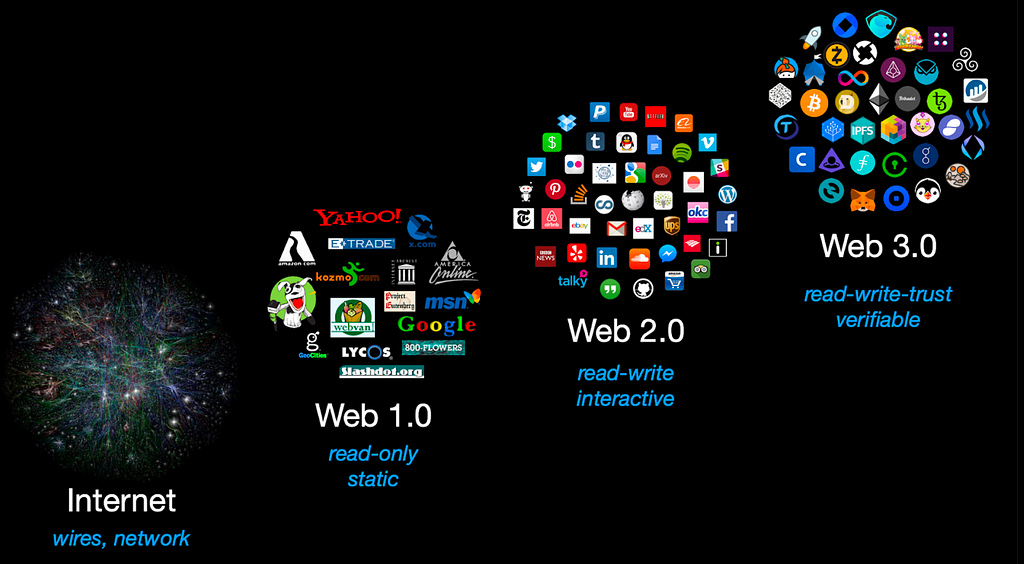

There already exist too many articles that try to explain what “Web 3” is. So why am I bothering to write this article? As both a computer scientist and a philosopher, Web 3 is uniquely interesting to me because it is fundamentally an ideological revolution enabled by a technological evolution.

The most crucial technological underpinning of Web 3 is the use of the blockchain. The blockchain is to Web 3 what the steam engine was to the Industrial Revolution — the underlying technological leap that powered a whole generation of new mechanisms. Fundamentally, the blockchain is a publicly-viewable, append-only data structure that is unique in its merging of three distinct fields: cryptography, distributed systems, and game theory [1].

Each of these three fields have contibuted a pillar to Web 3’s ideological evolution. Specifically, cryptography enables trustlessness, distributed-systems enables permanence, and game-theory enables voluntariness. In this article, I will use these three principles as primary axes to connect the dots between a myriad of Web 3 projects and lay the technological innovations of Web 3 side-by-side with their philosophical implications.

Trustlessness — Powered by Cryptography

Long long ago in a faraway land, the word “crypto” was merely shorthand for “cryptography” rather than “cryptocurrency.” Cryptography has always been, and likely will always be, the key technology (pun intended) underpinning cryptocurrencies. Public-key encryption (or asymmetric cryptography) allows users to send data anonymously without having said data be compromised.

This encryption of data is extremely important when building a financial system, whether centralized or decentralized. This is because you want to prevent prying eyes from being able to view and steal your funds. Imagine the outrage if you found out that your bank didn’t take any measures to protect your financial data, and everyone could view every single one of your financial transactions. Scary stuff.

This is even more important when you have a decentralized financial system, such as the Bitcoin blockchain. There is no centralized entity that you can take to court. If you’re funds are hijacked mid-transaction, they’re just gone. Tough luck. This is why the Bitcoin protocol takes so much care in protecting transactions through public-key cryptography. For a transaction to be deemed valid, the user has to provide a “digital signature,” a cryptographic hash of data that requires the user’s private key to create but only the user’s public key to verify [2]. Furthermore, the “wallet address” from which the user is sending the funds from is itself a hash of the user’s public key, providing an extra proof of authenticity that the user signing the transaction is the author of the wallet. Even a user’s public key itself is not revealed until a user decides to send a transaction. [3] All of these minute design decisions in the Bitcoin’s protocol shows how the blockchain is designed to operate on a trustless basis: trusting the process, rather than the people. After all, math is reliable, while people are not.

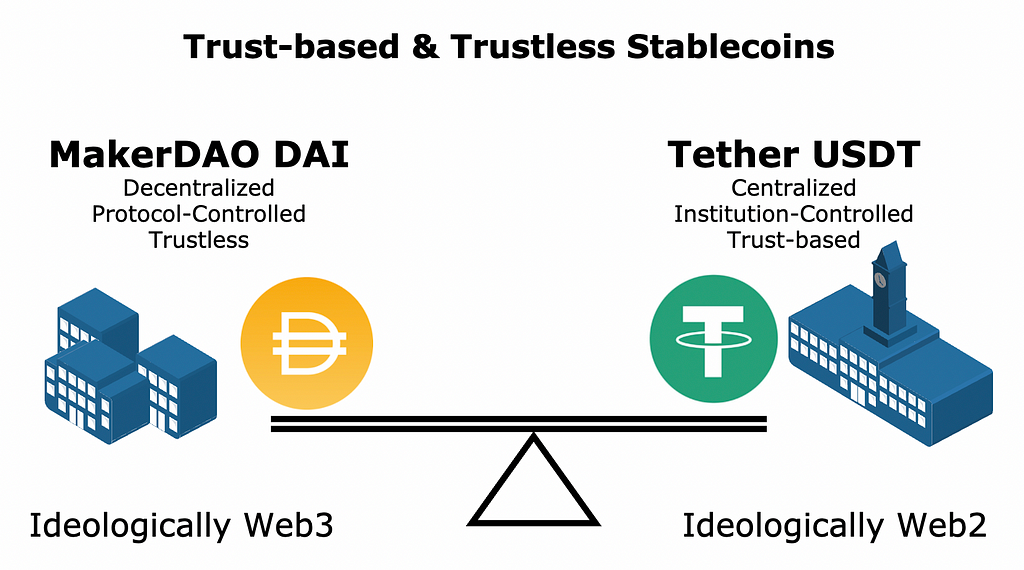

Trustlessness can be used as an important discriminator to determine which projects are ideologically Web 2 and which ones are truly Web 3 native. Consider two stablecoin projects, Tether’s USDT and MakerDAO’s DAI. Both are aimed at the same goal of maintaining a cryptocurrency token pegged 1:1 to the US Dollar. But they implement this in diametrically different ways.

In the case of Tether, the model is very simple. Whenever I give Tether a dollar, Tether will give me 1 USDT, promising that I can exchange that 1 USDT back for 1 dollar whenever I wish. The problem is, I need to trust that Tether won’t run away with my actual USD and “rug pull” me, leaving me with worthless USDT [4]. Tether is therefore an ideologically a Web 2 project, as it relies on my trust that Tether will keep my original USD safe and not just disappear with it [5].

On the other hand, MakerDAO’s DAI is an ideologically Web 3 project, and is arguably one of the most successful decentralized projects. DAI is kept afloat through MakerDAO’s “overcollaterized” lending protocol. To borrow 1000 DAI from MakerDAO, I need to lock up at least $1500 worth of ETH as collateral [6]. For the DAI stablecoin, the “over-collaterized loans” used to mint these DAI become the backing of the currency. When the price of DAI drops below $1, people will buy DAI on exchanges to pay back their DAI principle at a discount, thereby reducing the supply of DAI and putting the price up. On the other hand, if the price of DAI goes above $1, then people are incentivized to “mint” more DAI by putting up their ETH as collateral. This increased DAI supply and ETH collateral will cause the price of DAI to go back to $1 [7].

Instead of trusting a single centralized entity, such as Tether, you only need to trust the decentralized MakerDAO smart contract code to check that it functions as expected. If you want, you can even copy paste the code into your own environment, and run a bunch of demo tests to ensure that it works as expected. This allows for maximal transparency, and is a paradigmatic example of Web 3 ideology [8].

Importantly, decentralization is a means, whereas trustlessness is an end. Decentralization in an of itself does not constitute a “first principle,” as it does not make sense when there are significant economies of scale to be exploited. Consider the case of the garbage truck collection. Imagine instead of having a centralized garbage truck collect the garbage each week and drive it to the dump, this was “decentralized” so that everyone in the neighborhood had to drive to the dumps every week to take out their trash. This is a massive and unnecessary inconvenience. Thus, decentralization is not a panacea that will make everything inherently better.

Rather, decentralization makes sense only when the advantages of trustlessness, permanence, and voluntariness outweigh the economies of scale forsaken. For now, let’s focus on trustlessness. In the case of the garbage collection example, there aren’t really any clashing incentives between the players involved. People generally don’t really have a burning desire to know what’s inside your garbage. And your garbage probably doesn’t contain your most secret and precious items. As such, the stakes of trusting a centralized entity, such as a community garbage truck, is very low, and the economies of scale gained from centralizing far outweight the cost.

But in the case of banking data and financial transactions, the opposite is true. There isn’t really that much of an economy of scale for you to keep your money in a centralized bank rather than in cash in your own safe. On the other hand, many people would have a burning desire to have your money. Thus, decentralizing a financial system to ensure a trustless network has advantages that far outweigh its costs. That’s why Bitcoin makes sense as a blockchain project.

Permanence — Powered by Distributed Systems

Fundamentally, economies of scale are also vulnerabilities of scale. Having a single point of failure is incredibly fragile, and not conducive for data “permanence.” Just as how animals reproduce to increase their DNA’s chances of survival in an uncertain environment, copying data to multiple locations and “nodes” makes this data much more resilient to bugs, hacks, and system failures. Decentralization, through storing the same data on various machines rather than a single one, is also a great idea to achieve this principle of permanence.

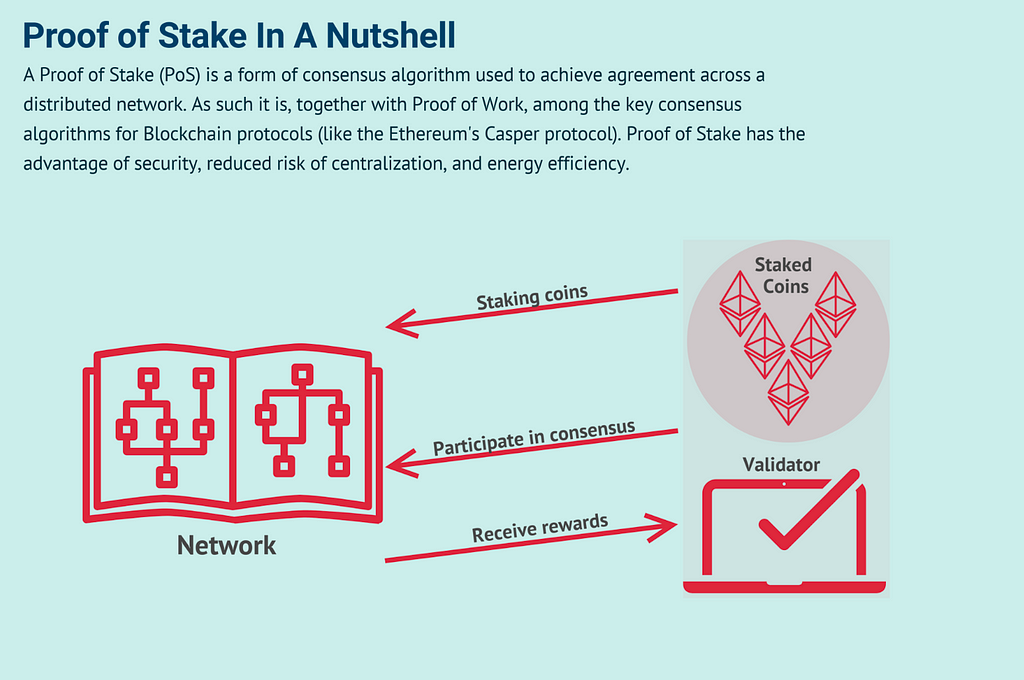

But coordinating data across distributed systems is a hard problem [9]. How do you deal with data corruption and the malicious actors that inevitably infiltrate the distributed network? The key idea that modern blockchains employ is the concept of “Byzantine Fault Tolerance,” which suggests that a blockchain should continue to operate so long as “bad actors” constitute no more than 1/3 of the network’s total nodes [10]. Essentially, when a node on the network proposes a block to append to the blockchain, it needs to gather the signatures of at least 2/3 of the node validators before it is deemed to be valid. This signature-gathering process is called “consensus.” While modern blockchains implement “consensus” in different ways (Bitcoin’s Proof of Work, Ethereum’s Proof of Stake, Solana’s Proof of History), they are all “Byzantine Fault Tolerant.” Crucially, as the number of the nodes increases, a “Byzantine Fault Tolerant” blockchain enjoys a decentralized economy of scale, where it becomes harder for a hacker to control enough nodes to attack the blockchain at the consensus level.

Now that we have established how “permanence” is achieved through distributed systems in the blockchain, we need to ask: what should be permanent and stored on the blockchain? Going back to the garbage truck example, you obviously don’t care if your garbage disappears (in fact you actively want for it to disappear). On the other hand, you obviously don’t want your money to suddenly disappear one day. So financial transactions, such as the Bitcoin ledger, are an obvious area where permanence is important. But that’s not all. There has always been an innate human drive to forge a permanence out of our impermanent life, whether that is through religion, stories, sculptures, or monuments [11]. Digital mementos, such as personal websites, photo albulms and game achievements all represent this desire for permanence in an everchanging life. These are just as precious to us, if not more, than our actual money.

Right now, we mostly store these items on a hard-drive, or in a cloud backup. But these are fundamentally unreliable. What happens if you lose your hard-drive? What if Google or Dropbox are hacked? What if they steal your data? These Web 2 solutions are fundamentally reliant on an element of trust; these companies can censor and delete your data any time they want. But the distributed consensus enabled Web 3 solutions are completely different. Herein lies the promise of a “permaweb,” one which can preserve your most precious digital assets for as long as you wish, without the worry of censorship [12].

One of the most prominent projects building the permaweb is Arweave, which promises permanent, distributed storage for a small upfront fee. While the design of Arweave is heavily inspired by the blockchain, it does not technically implement a blockchain. Fundamentally, a blockchain is a one-dimensional linked-list where one block points only to the last block. On the other hand, Arweave uses a “blockweave,” where each “block” can point to multiple blocks, forming a two-dimensional graph, similar to the “file system tree” on your laptop [13]. This design allows for a more efficient access of content. In the consensus mechanism, Arweave also uses a “Proof of Random Access” method, ensuring that every node can randomly access data stored on the blockweave.

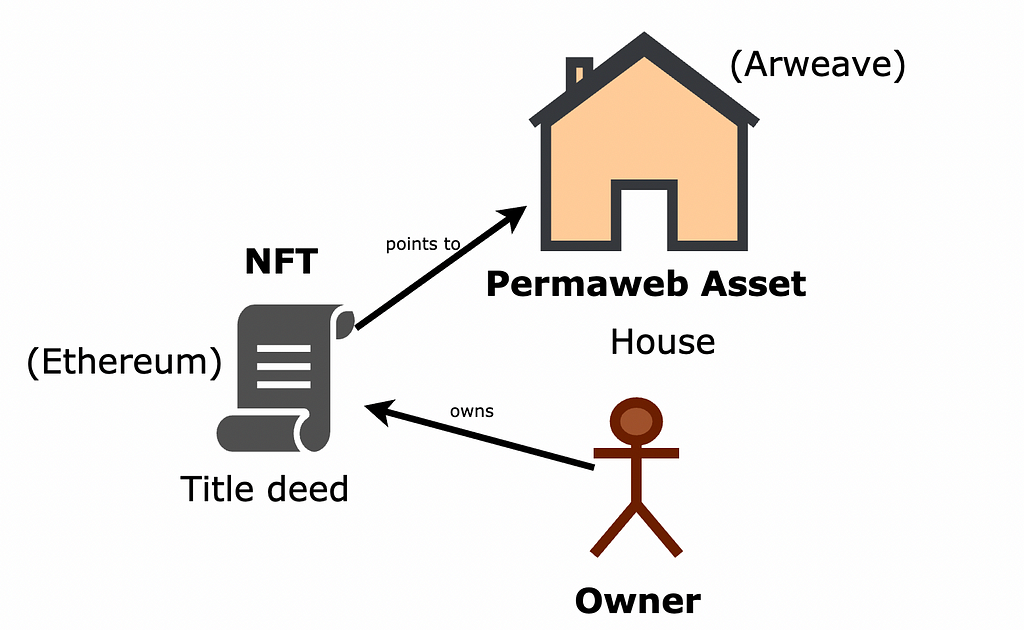

As you may expect, Arweave and other decentralized “permaweb” protocols (such as IPFS) have a natural affinity with Non-Fungible Tokens, or NFTs [14]. If permaweb assets on Arweave and IPFS are a house, then NFTs are the house’s title deeds. The “house” itself may be available to view by anybody visiting it or passing by the street. But only the owner holds the title deed to the house. And when the owner sells the house to another owner, she doesn’t do anything to the house itself; she only hands it over the the buyer. Having a title deed NFT makes the ownership and transfer of the asset practical and cryptographically-ensured. Thus, NFTs are more than “vanity plates for crypto bros”; they have a practical use as title deeds of digital assets. But a title deed is only as valuable as the asset its pointing to. So let’s try and use NFTs to point to something other than the picture of an ape.

Voluntariness — Powered by Game Theory

A third tenet in the unique ideology of Web 3 is a game theory enabled voluntariness. People don’t become nodes on a network out of altruism or the kindness of their hearts. They’re in it for the money. This game theory induced voluntariness manifests itself in all sorts of places, most notably in the “Proof of Stake” consensus models that underlie many of the top blockchains, including Ethereum, Polygon, and Binance Smart Chain [15]. As the infographic shows, essentially you “stake out” a certain number of coins, such as 32 ETH on Ethereum, onto the network to become a validator and participate in consensus. If you are an honest actor on the network, you will receive “staking rewards,” reaching around a ~10% APY. On the other hand, if you are discovered to be a malicious actor, your staked coins (the 32 ETH) will be “slashed,” and you will lose all your rewards. So you have a game-theory incentive to be an honest node on the network.

Another application of game-theory induced voluntariness is in Decentralized Exchanges (DEXs) such as Uniswap and Curve, which decentralized smart contracts that act as cryptocurrency exchange stations. Where does the money for these DEXs come from? They come from voluntary users, called Liquidity Providers (LPs), that provide a pair of coins they own onto the exchange so that the traders can use to swap them. In return, these LPs will receive part of the transaction fees that the traders have to pay through the DEX, thus effectively earning “interest” on their pooled coins [16].

Crucially, unlike in Web 2, where Google and Facebook forces its algorithm upon you, no one is forcing you to stake on Ethereum or become a Uniswap LP. You use it out of your own accord, because you know you can have the chance for massive earnings. Ideologically Web 3 communities are completely self-voluntary, and community actions are fundamentally driven by game theory.

This idea of game-theory driven voluntariness is not only present in Decentralized Finance (DeFi) projects, but also Web 3 communities at large, most notably in the form of a DAO, or a Decentralized Autonomous Organization. These organizations bring together a bunch of people with a similar end-goal in mind (such as purchasing the US Constitution, in the case of ConstitutionDAO) [17], and allow people to democratically vote on proposals using “governance tokens,” or a token issued by the DAO to track membership and make collective decisions on how to spend community resources.

Unfortunately, today truly decentralized and ideologically Web 3 DAOs are rare. Many projects purport to be DAOs by having a “governance token” of some sort, but because the comapny that runs the project may hold the lion’s share of the tokens, even if there is voting, the project is de facto centralized. Thus, these governance-tokened “pseudo-DAOs” are ideologically Web 2 under the hood, even as they assume the luring façade of a decentralized organization.

Thus, game-theory induced voluntariness gives us another important principle to discriminate between ideologically Web 2 projects versus ideologically Web 3 projects. The former are characterized by having a single, centralized entity determining how users will interact with it, whereas the latter will have the users democratically vote upon the community’s collective actions.

Conclusion

Web 3 is still in its infancy, and still has a long way to go. Nonetheless, we can already begin to see its revolutionary view of the future, with an ideology based on trustlessness, permanence, and voluntariness. Of course, there are still a lot of structural issues that Web 3 has to face. For example, how do you move forward when the “company” behind a project and its community fundamentally disagree with one another? Does the company steamroll the community or abdicate its power to it? Furthermore, how can the blockchain be used to connect offline, real-life resources and objects? Or here’s another interesting problem: are financial punishments (such as slashing) enough to deter any malicious actors? Do we still need to resort to physical violence to truly “punish” people? I’m sure that in the future, more Web 3 native projects will gradually evolve out satisfactory responses to all these questions.

But there is one pressing and lingering question that remains: what will Web 3 do to Web 2? How will the centralized and decentralized internet interact with one another? Recall that fundamentally, an ideologically Web 3 project is a voluntary project. It relies on willing participants, incentivized by game theory rewards, to participate in the active maintenance of a decentralized community. If no one is willing to vote, participate, and commit, a DAO will either disband or devolve into a de-facto centralized entity. After all, a democracy doesn’t work if no one votes in it. But everyone has a limited amount of time, energy, and effort, and not everyone cares about the same things. So oftentimes, people may actually prefer someone else making decisions for them, as this takes far less mental effort — a Web 2 algorithm, which essentially has an AI making the choices for them.

Thus, I envision a world where Web 2 and Web 3 essentially coexist. In the parts of our lives that we really care about, perhaps a community project, art collection, or online game, we can actively participate and earn in a Web 3 DAO or community. But in the other parts that we would prefer to autopilot, we can use Web 2 solutions and AI systems that happily make the decisions for us. The important part is that Web 3 gives us a choice, a viable alternative to “choose our own destiny” for the parts of our lives that we really care about, as opposed to just having a totalitarian AI governing every facet of our daily routine. Remember that in Web 3, we don’t need to rely on anyone’s trust, we can ensure that what we do will be kept as long as we wish, and we can define our priorities on our own accord.

And so, the wind of freedom shall blow.

🐦 @0xfishylosopher

📅 14 October 2022

References

[1] From Prof. Dan Boneh, Stanford’s CS 251: https://cs251.stanford.edu/

[2] See https://river.com/learn/how-bitcoin-uses-cryptography/

[3] Bitcoin Whitepaper: https://bitcoin.org/bitcoin.pdf

[4] Introduction to Tether: https://www.forbes.com/advisor/investing/cryptocurrency/what-is-tether-usdt/

[5] For more of the Tether controversy: https://www.forbes.com/sites/seansteinsmith/2022/08/28/crypto-accounting-matters-and-tether-is-finally-moving-in-the-right-direction/?sh=16a1241b72e3

[6] From Coindesk: https://www.youtube.com/watch?v=J9q8hkyy8oM

[7] See answer to https://ethereum.stackexchange.com/questions/89328/how-does-the-dai-peg-to-dollar/102052#102052

[8] Vitalik Buterin on MakerDAO’s significance: https://www.youtube.com/watch?v=XlYyj0WFi9Y

[9] See State Machine Replication: https://en.wikipedia.org/wiki/State_machine_replication

[10] Details of Byzantine Fault Tolerance: https://decrypt.co/resources/byzantine-fault-tolerance-what-is-it-explained

[11] An interesting exploration of this topic is British philosopher John Gray’s book: “The Immortalization Commission”

[12] Introduction to the Permaweb: https://arweave.medium.com/welcome-to-the-permaweb-ce0e6c73ddfb#

[13] https://arweave.news/what-is-arweave-ar/

[14] https://docs.ipfs.tech/how-to/mint-nfts-with-ipfs/

[15] https://wiki.polygon.technology/docs/home/polygon-basics/what-is-proof-of-stake/

[16] Introduction to Uniswap: https://whiteboardcrypto.com/uniswap-v3/

[17] ConstitutionDAO: https://coinmarketcap.com/alexandria/article/constitutiondao

New to trading? Try crypto trading bots or copy trading

💡 The Ideology of Web 3 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link