[ad_1]

The below is a direct excerpt of Marty’s Bent Issue #1271: “Soaring rates, begging and bitcoin’s relative strength.” Sign up for the newsletter here.

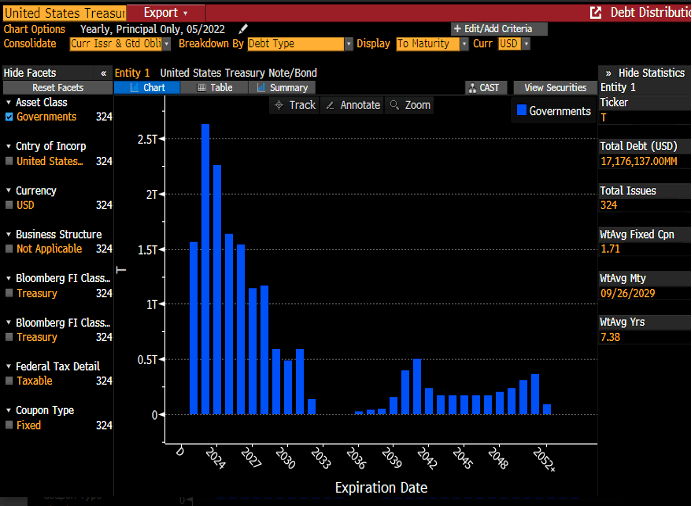

Last week, we discussed the fact that credit default swap spreads for sovereign nations are becoming completely detached from their historical averages. In that piece, we highlighted that rapidly rising rates will begin to have a material effect on the interest payments on sovereign debt. Our friend Lawrence Lepard did some rough calculations on the exact impact this type of high-rate environment will have on the amount of money the U.S. government will owe their counterparts in interest payments if rates continue to rise. At this rate, interest payments will be about 3.5 times what they were in 2020. Of course, this won’t happen right away as a lot of these Treasurys need to mature. However, if you take a look at the maturity calendar, a considerable amount of these Treasurys are due to mature over the next two years.

via Lawrence Lepard

While interest payments on the U.S.’ sovereign debt may not balloon to $1.2 trillion immediately, they will begin to increase materially in pretty short order. This is happening as tax revenues are all but certain to fall dramatically as Americans attempt to deal with a rate of inflation that is screaming far beyond what’s reported via the consumer price index; and as capital gains tax revenues dry up as most will probably have to report losses on their stock portfolios and home sales. Anyone with a lick of common sense and rudimentary math skills can see that this problem is about to have a material effect on people’s confidence in the U.S. government’s ability to pay its debts — and, by extension, overall confidence in the U.S.’ ability to be the “leader” of the Western world. It doesn’t matter how much the DXY rallies.

Not only that, but everyone who has become wholly dependent on the easy money gravy train that left the station in 2008-2009 is literally beginning to beg for the Federal Reserve to reverse course on their hawkish policy. In the last three weeks alone, we’ve seen the U.N., the International Monetary Fund (IMF) and ARK Investment’s Cathie Wood come out and ask the Fed directly and indirectly to reverse course.

(Source)

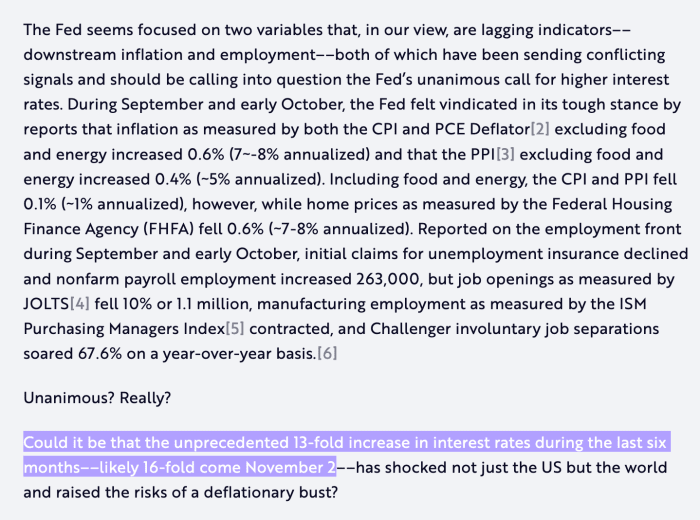

via ARK Invest

via ARK Invest

We find ourselves in very weird times. Everyone from the U.N. to the IMF to large asset managers is coming out and admitting that their way of being is wholly dependent on the gravy train barreling down the tracks at full speed. They have built their worldview around a dependence on central planning and free money flows that push up the prices of the assets they own and lull the world into a false sense of security. Markets have been forced to quit their heroin addiction cold turkey and the withdrawal shakes are more violent than anyone could ever imagine they would be. The world is wandering into uncharted territory. As the heroin addicts beg their dealer to give them their fix, bitcoin is quietly showing relative strength in the background.

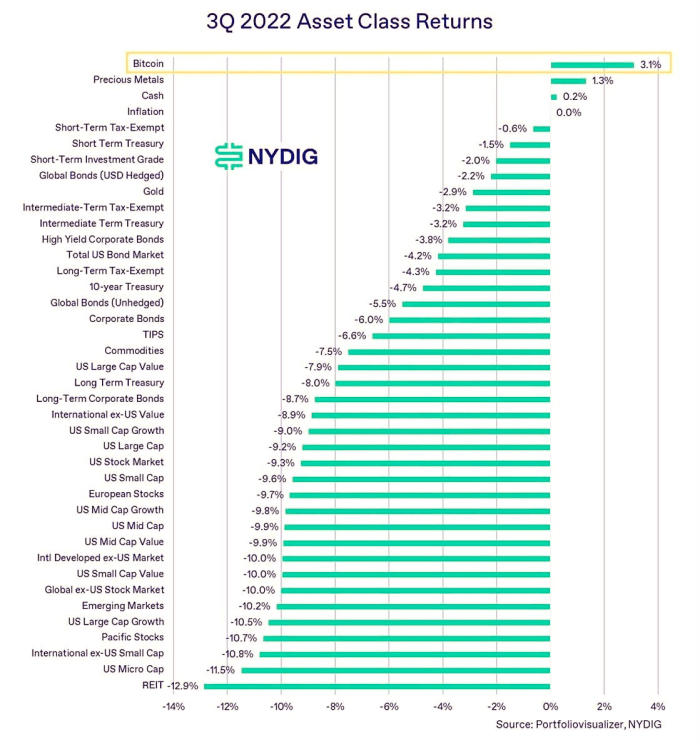

via NYDIG

As those in the mainstream continue to pooh-pooh $18,000-$20,000 bitcoin after an approximately 75% fall from highs attained late last year, the nascent peer-to-peer digital cash system seems to be developing a stable base as everything around it begins to crumble at an increasing pace. This is something to keep an eye on in the weeks and months to come. Who knows whether or not this relative stability will continue moving forward? If it does, while everything else continues to crash, it would be a massive signal that there are likely more and more individuals out there recognizing the value proposition that bitcoin provides as a monetary good divorced from the whims of the central planners who have lit the world on fire.

Could the decoupling be upon us? We shall see.

[ad_2]

Source link