[ad_1]

The debate around whether or not this policy is a form of quantitative easing misses the point: Liquidity is the name of the game for global financial markets.

The article below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

QE Or Not QE?

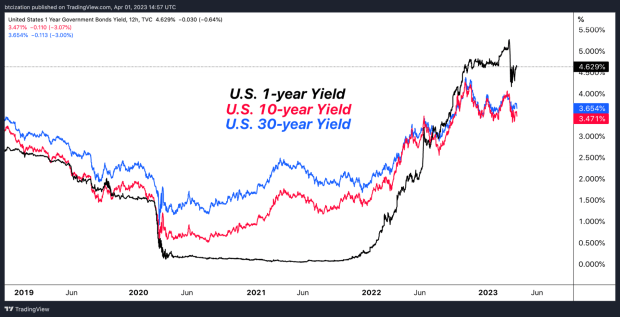

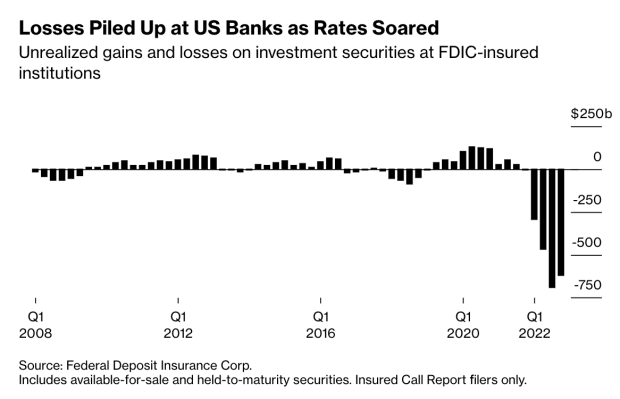

The Bank Term Funding Program (BTFP) is a facility introduced by the Federal Reserve to provide banks a stable source of funding during times of economic stress. The BTFP allows banks to borrow money from the Fed at a predetermined interest rate with the goal of ensuring that banks can continue to lend money to households and businesses. In particular, the BTFP allows qualified lenders to pledge Treasury bonds and mortgage-backed securities to the Fed at par, which allows banks to avoid realizing current unrealized losses on their bond portfolios, despite the historic rise in interest rates over the past 18 months. Ultimately, this helps support economic growth and protects banks in the process.

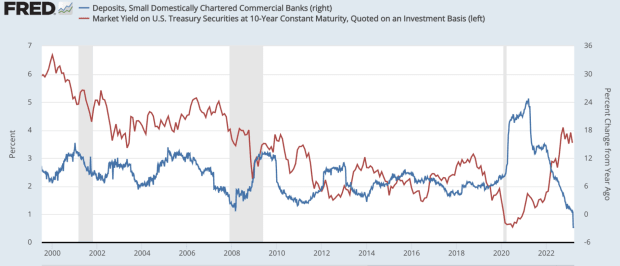

The cause for the tremendous amount of unrealized losses in the banking sector, particularly for regional banks, is due to the historic spike in deposits that came as a result of the COVID-induced stimulus, just as bond yields were at historic lows.

Shown below is the year-over-year change in small, domestically chartered commercial banks (blue), and the 10-year U.S. Treasury yield (red).

TLDR: Historic relative spike in deposits with short-term interest rates at 0% and long-duration interest rates near their generational lows.

The reason that these unrealized losses on the bank’s security portfolios have not been widely discussed earlier is due to the opaque accounting practices in the industry that allow unrealized losses to be essentially hidden, unless the banks needed to raise cash.

The BTFP enables banks to continue to hold these assets to maturity (at least temporarily), and allow for these institutions to borrow from the Federal Reserve with the use of their currently underwater bonds as collateral.

The impacts of this facility — plus the recent spike of borrowing at the Fed’s discount window — has brought about a hotly debated topic in financial circles: Is the latest Fed intervention another form of quantitative easing?

In the most simple terms, quantitative easing (QE) is an asset swap, where the central bank purchases a security from the banking system and in return, the bank gets new bank reserves on their balance sheet. The intended effect is to inject new liquidity into the financial system while supporting asset prices by lowering yields. In short, QE is a monetary policy tool where a central bank purchases a fixed amount of bonds at any price.

Though the Fed has attempted to communicate that these new policies are not balance sheet expansion in the traditional sense, many market participants have come to question the validity of such a claim.

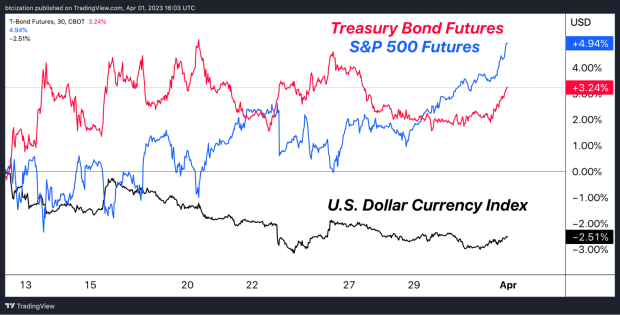

If we simply look at the response from various asset classes since the introduction of this liquidity provision and the new central bank credit facility, we get quite an interesting picture: Treasury bonds and equities have caught a bid, the dollar has weakened and bitcoin has soared.

On the surface, the facility is purely to “provide liquidity” to financial institutions with constrained balance sheets (read: mark-to-market insolvency), but if we closely examine the effect of BTFP from first principles, it is clear that the facility provides liquidity to institutions experiencing balance sheet constraint, while simultaneously keeping these institutions from liquidating long-duration treasuries on the open market in a firesale.

Academics and economists can debate the nuances and intricacies of Fed policy action until they are blue in the face, but the reaction function from the market is more than clear: Balance sheet number go up = Buy risk assets.

Make no mistake about it, the entire game is now about liquidity in global financial markets. It did not used to be this way, but central bank largesse has created a monstrosity that knows nothing other than fiscal and monetary support during times of even the slightest distress. While the short-to-medium term looks uncertain, market participants and sidelined onlookers should be well aware as to how this all ends.

Perpetual monetary expansion is an absolute certainty. The elaborate dance played by politicians and central bankers in the meantime is an attempt to make it look as if they can keep the ship afloat, but in reality, the global fiat monetary system is like an irreversibly damaged ship that’s already struck an iceberg.

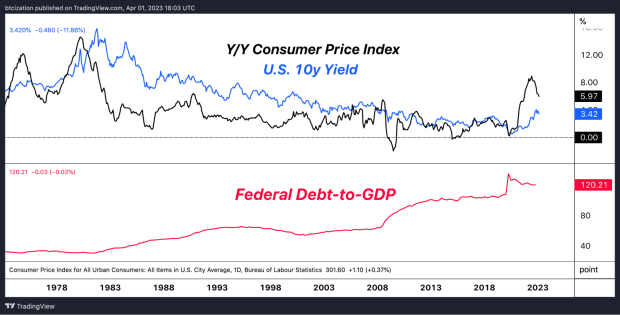

Let us not forget that there is no way out of 120% debt-to-GDP as a sovereign without either a massive unforeseen and unlikely productivity boom, or a sustained period of inflation above the level of interest rates — which would crash the economy. Given that the latter is extraordinarily unlikely to occur in real terms, financial repression, i.e., inflation above the level of interest rates, appears to be the path going forward.

Final Note

For the layman, there is no dire need to get caught up in the schematics of the debate whether recent Fed policy is quantitative easing or not. Instead, the question that deserves to be asked is what would have happened to the financial system if the Federal Reserve didn’t conjure up $360 billion worth of liquidity from thin air over the last month? Widespread bank runs? Collapsing financial institutions? Soaring bond yields that send global markets spiraling downwards? All were possible and even likely and this highlights the increasing fragility of the system.

Bitcoin offers an engineering solution to peacefully opt out of the politically corrupted construct colloquially known as fiat money. Volatility will persist, exchange rate fluctuations should be expected, but the end game is as clear as ever.

That concludes the excerpt from a recent edition of Bitcoin Magazine PRO. Subscribe now to receive PRO articles directly in your inbox.

Relevant Past Articles:

- Another Fed Intervention: Lender Of Last Resort

- Banking Crisis Survival Guide

- PRO Market Keys Of The Week: Market Says Tightening Is Over

- Largest Bank Failure Since 2008 Sparks Market-Wide Fear

- A Tale of Tail Risks: The Fiat Prisoner’s Dilemma

- The Everything Bubble: Markets At A Crossroads

- Not Your Average Recession: Unwinding The Largest Financial Bubble In History

- Just How Big Is The Everything Bubble?

[ad_2]

Source link