[ad_1]

- 🖌️ Now we can share NFTs on Facebook and IG?

- 🐰 Disney makes bold Metaverse moves

- 👨👩👧👧 Startupy — Community-curated search engine

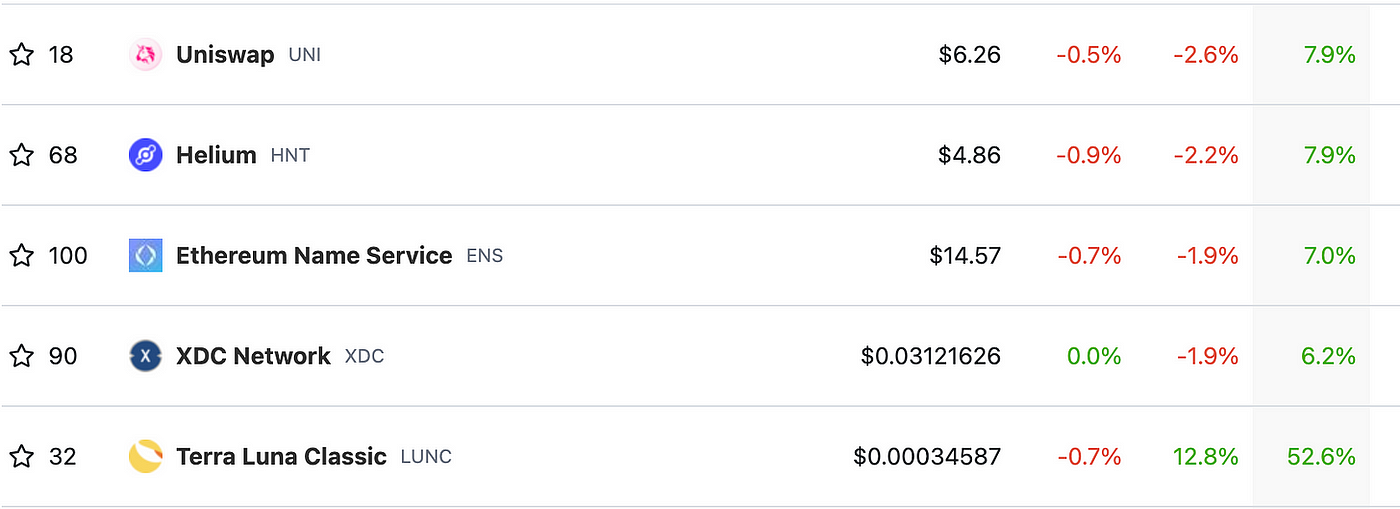

- 📈 Top 5 performers of the week

- 📙 A quick guide to Stablecoins

- 📰 Top Reads

- 🙏🏻 Grateful for…

Meta is allowing anyone to connect their crypto wallet and share their Ethereum, Flow, and Polygon NFTs with friends and followers.

A non-fungible token (NFT) is a unique digital identifier that cannot be copied, substituted, or subdivided, recorded in a blockchain, and used to certify authenticity and ownership. The ownership of an NFT is recorded in the blockchain and can be transferred by the owner, allowing NFTs to be sold and traded. NFTs can be created by anybody, requiring few or no coding skills. NFTs typically contain references to digital files such as photos, videos, and audio. Because NFTs are uniquely identifiable assets, they differ from cryptocurrencies, which are fungible.

Continuing its recent rollout, tech giant Meta announced today that its NFT collectibles support is now available to all Facebook and Instagram users within the United States.

Meta first began enabling NFT support on its platforms in May with Instagram, and then added Facebook support in June. In both cases, the firm started with a limited number of users but has gradually expanded the pool over time.

Now anyone in the U.S. can showcase their NFTs, joining users in some 100 other countries across Asia-Pacific, Africa, the Middle East, and the Americas.

Facebook and Instagram support wallet connections MetaMask, Dapper Wallet, Coinbase Wallet, Rainbow, and TrustWallet. The feature is available from the “digital collectibles” tab in settings in both mobile apps.

Disney’s CEO has revealed that they are continuing to explore and develop their plans for the metaverse. Speaking at Disney’s biennial D23 Expo fan convention, Chief Executive of Walt Disney Co Bob Chapek described how the 98-year-old company will use the technology moving forward.

Earlier this year, Disney hired Mike White to lead the newly formed unit. In addition, they also hired Mark Bozon for their metaverse creative strategy. Notably, Mark spent 12 years at the tech giant Apple before joining Disney. The company plans to continue its hiring spree to speed up its web3 plans.

Disney wants to use data from the physical and digital worlds to drive its metaverse policy, says the CEO. Data from theme park visits and consumer streaming habits are two sectors Disney is considering for their metaverse strategy.

Disney describes their metaverse vision as “next-generation storytelling.”

Additionally, Disney has also been active in the NFT space. Working with VeVe, the NFT marketplace, they launched the ‘Golden Moments’ collection. This includes Spiderman, Mickey Mouse, Marvel, Pixar collections, and more.

Uniswap is a cryptocurrency exchange that uses a decentralized network protocol. Uniswap is also the name of the company that initially built the Uniswap protocol. It facilitates automated transactions between cryptocurrency tokens on the Ethereum blockchain through the use of smart contracts. As of October 2020, Uniswap was estimated to be the largest decentralized exchange and the fourth-largest cryptocurrency exchange overall by daily trading volume.

Stablecoins are just cryptocurrencies with their value pegged against some “stable” assets such as precious metals or fiat currencies such as the US Dollar. (Yes, we know, the dollar and other FIATs are not that stable, but not as volatile as most cryptos).

The different stablecoin categories are basically indicative of the assets backing them. A detailed understanding of the different types of stablecoins could help you establish promising foundation-level knowledge of stablecoins.

101 Blockchains

- Fiat-collateralized stablecoins are the foremost variant of stablecoins you would come across. They have the backing of a fiat currency such as Euro, GBP, or the US Dollar. Fiat-collateralized stablecoins are the simplest stablecoin types with a 1:1 ration backing. The 1:1 ration implies that one stablecoin would be equal to one unit of currency such as a dollar or one Euro.101 Blockchains.

- The second entry in answers to ‘what are the different types of stablecoins?’ brings the limelight on commodity-backed stablecoins. As the name clearly implies, commodity-backed stablecoins have the backing of different types of interchangeable assets such as precious metals. The most common commodity used as collateral for commodity-backed stablecoins is gold.

- What about the volatility of cryptocurrencies? How can you expect stability in stablecoins which are backed by cryptocurrencies? As a matter of fact, crypto-collateralized stablecoins offer better decentralization in comparison to fiat-collateralized stablecoins. In addition, stablecoins are generally over-collateralized for absorbing price fluctuations as collateral.

- The final addition among stablecoin categories would take us to non-collateralized or algorithmic stablecoins. Non-collateralized or algorithmic stablecoins do not have any assets or collateral for backing them. So, how are algorithmic stablecoins classified as stablecoins when they don’t have any collateral for backing them up?

- The non-collateralized or algorithmic stablecoins follow an algorithm for controlling the stablecoin supply. Such a type of approach is also known as seignorage shares. With the rise in demand, new stablecoins will be created to reduce the price to the normal level. In event of considerably low coin trading, coins on the market are purchased up for reducing the circulating supply.

[ad_2]

Source link