[ad_1]

This is an opinion editorial by Captain Sidd, a finance writer and explorer of Bitcoin culture.

Over the past two years, the topic of inflation went mainstream. Instead of a slow and steady 2% inflation rate in the U.S., we’ve seen 10%-plus annualized inflation in goods that are critical to our survival, like food and energy.

Over that same time period, the price of bitcoin topped a parabolic rally at an exchange rate of around $70,000, flatlined, and then steadily lost value against the dollar to where we are today, around $20,000 per bitcoin.

From this perspective, bitcoin may seem to have failed as a hedge against price inflation to date. However, bitcoin is a very small asset on the world stage, largely ignored by most of the world’s population to date.

Instead of analyzing bitcoin, let us look at the U.S. dollar. The U.S. dollar is the world’s reserve currency, issued by the nation with the world’s most powerful and advanced military.

The dollar, more than bitcoin, has a story to tell about inflation and how to survive it.

Taking A Critical Look At The Dollar

Unless you work in finance, you may think of the prices of goods as one-sided: you have bread, and it is priced in dollars. If the price of bread goes up, it must be because of some change in the inputs to that bread or a decision of the company that sells it. I’d guess most people never think about how the changing price of bread might involve a change in the dollar rather than the bread itself.

Markets, and prices, are expressed in pairs. If you’ve ever traded cryptocurrencies, you may remember that markets are displayed in terms such as BTC/USD, BTC/EUR, ETH/BTC and so on. You can also trade the inverse of any of these, but usually the more liquid asset is the denominator. In other words, the more liquid asset denominates the market.

In everyday transactions, we just call this relationship a price. If the BTC/USD market shows us one bitcoin is equal to 20,000 dollars, we just say the price of bitcoin is $20,000. Same goes for everything you buy at any store, although the pricing mechanisms for final goods like cars and snacks are more complex and less transparent than a currency.

Simplifying a market pair like bread for dollars down to a price obscures the role of the denominating currency in that price. We forget that dollars are half of the bread for dollars transaction, so when the price of bread moves, we only look for changes in the production of bread. This can mislead us.

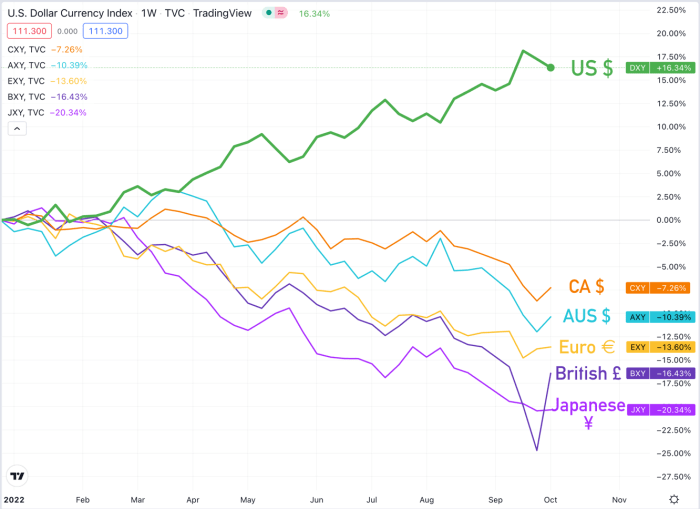

Let’s look at currencies against each other. In the last few weeks, we saw many fiat currencies falling against the dollar in tandem. Are all of these countries each taking actions that are debasing their currencies in precisely the same way against the dollar, or is the Federal Reserve to blame? Given that the Fed has steadily raised rates this year, the dollar looks to be the culprit in the moves of these other currencies.

When prices for goods are all rising together against the dollar, as is the case today, it is more productive to look at the supply and demand of the dollar than at how goods and services are produced.

Let’s look at the Federal Reserve and the U.S. dollar as an example of the effects a central bank has on its economy by controlling the supply of their monetary unit.

The Fiat Roller Coaster

The Federal Reserve holds immense power over our daily lives through its control of the availability of U.S. dollars and credit. Under the gold standard prior to 1971, a fixed supply of gold and a promise to redeem dollars for gold at a fixed rate held the printing of new dollars in check. Now that this limit is gone, the Federal Reserve is free to print as many dollars as it desires.

The Fed’s playbook since 1971 is both genius and diabolical, depending on your ethics and how much their moves benefit your wallet. The playbook resembles a roller coaster ride.

First, the ascent. The Fed uses its tools to flood the economy with cheap credit. Businesses and individuals take out loans to expand operations, buy assets and live a good life. If a business owner resists taking on debt, they risk being wiped out by competitors who use loans to expand and take market share. There is a prisoner’s dilemma here, so everyone rushes into debt lest they be left behind. GDP grows steadily, signaling positive policy results to number crunchers in Federal Reserve offices.

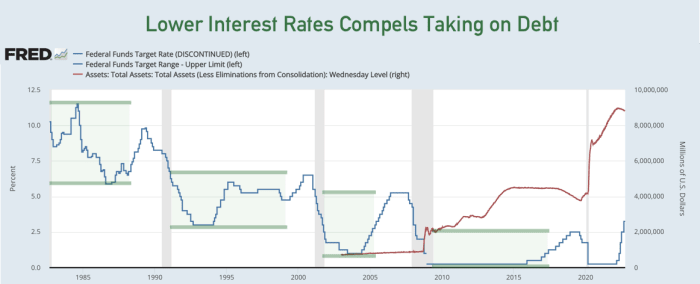

The Fed lowers rates and then keeps them low during boom times, causing unsustainable debt to amass among individuals and businesses. Gray bars indicate recessions. Source: Federal Reserve FRED

In the boom period between 1982 and 1990, we saw interest rates come down from levels far above 10% to range between 6% and 11.5%. In the boom between 1991 and 2001 rates oscillated between 3% and 6%. From 2001 to 2008 rates went as low as 1%, gradually climbing from 2004-2006 where they leveled off at 5.5%. After 2009 and until the COVID-19 crash, rates sat around 0% until hiking to 2.5% began in 2016. Each period kept rates generally lower than the last period, stimulating businesses and individuals to take on debt.

Second, the crest. As the Fed attempts to remove liquidity from the market to temper growth, they make further debt financing more costly. This gradually slows consumer and business purchasing, which lowers revenues and makes servicing existing debt more difficult. It may take years, but at some point an acute solvency crisis appears when critical entities or businesses cannot service their existing debt any longer. This is when the fall begins: recession.

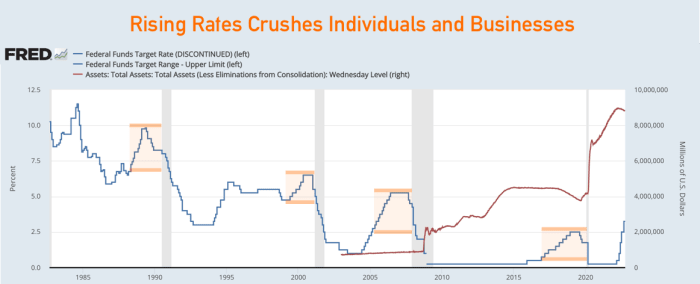

When the Fed hikes rates, they trigger a cascading deleveraging event, each worse than the last. This leads into recessions, represented by gray bars. Source: Federal Reserve FRED

The fall is marked by financial tightening turning into a full blown recession. Going into the 1990 recession was an acute oil price shock as a result of Iraq’s invasion of Kuwait, and an ongoing savings and loan crisis directly affected by rising interest rates in the preceding few years. The bursting of the dotcom bubble in the year 2000, just as the Federal Reserve raised interest rates, drove the entire economy into recession. The housing bubble that developed over the 2000s thanks to low interest rates ran out of steam and brought the economy to recession in 2008 after a few years of rate hikes collided with bad mortgages. Hiking rates from 0% to around 2.5% from 2016 to 2019 causes banks to stop lending to each other in the critical overnight repo market, putting the financial system at risk in 2019.

As a result of all the debt taken on during the boom times combined with the rising cost of capital from higher interest rates, a solvency crisis creates a sharp and painful fall in prices. This usually occurs first in financial assets as businesses liquidate what they can to avoid defaulting on debt. To halt the fall and stop a “contagion” event where one institution failing brings down others, the Fed again steps in to flood the economy with cheap credit. This credit fills the gaping hole that asset prices were about to drop through. We see the Fed dropping interest rates shortly before all aforementioned recessions, as acute credit crises rear their ugly heads.

Post-2008, interventions to save the status quo expanded beyond interest rate manipulation to direct bailouts (“quantitative easing”) and government fiscal intervention in the form of stimulus checks and widespread unemployment relief issued directly to citizens in 2020.

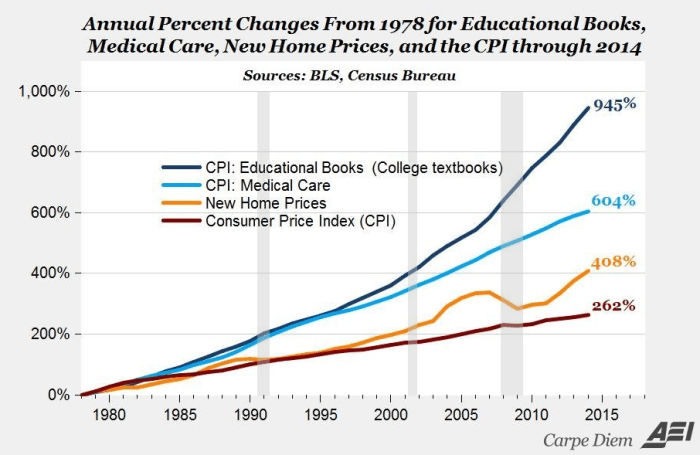

Following these crashes, we are back at the beginning of our roller coaster. However, all is not the same as before. Prices around the economy stabilize at a higher level than before the roller coaster ride began, and inflation continues unabated.

Prices continue marching upwards, despite recessions. Source: AEI, edited by author

Most disturbingly, each drop on the roller coaster drives a reallocation of wealth from productive workers and entrepreneurs to unproductive owners and the politically favored. Those institutions that make themselves politically important benefit from direct bailouts by the Federal Reserve and government, as we saw in the 2008 and 2020 recessions. Unproductive owners and politically connected individuals start to fill up the 1%. Their businesses overtake other businesses, regardless of the benefit to the customer.

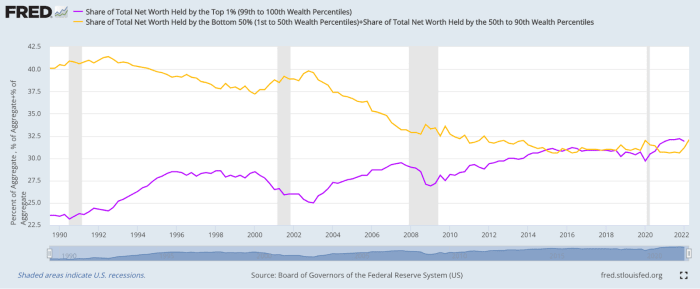

Wealth concentrates during the boom, briefly redistributes during a deleveraging, and then continues to amass among the 1% starting at an even higher level. Source: Federal Reserve FRED

Fed policy before, during and after each recession is consistent. Each recession is primarily a liquidity crisis — stemming from centralized management of the dollar — not an external act of war, God or corporation. The Fed’s acts do not temper existing business cycles; they create them. This perpetuates a monetary system that encourages widespread addiction to debt, widens the wealth gap and crushes people into poverty and dependence through steady price inflation.

This cycle is also politically self-perpetuating. Since crashes are caused by a deleveraging of the debt taken on during times of low interest rates, the government can signal that the greed of corporations and the wealthy created the crisis. In reality, it is artificially low interest rates that create an environment where all businesses must become indebted in order to stand a chance against their competitors. However, many voters are lulled into believing that capitalism and the free market is the problem. These voters willingly hand over more power to the government and central bank, leading to even worse crises.

Today’s Crisis Of Inflation

Since the early 1980s, despite the ongoing flood of capital from consistently declining interest rates, reported inflation in America has settled around 2% annually. Even if you disagree that America successfully exported inflation to developing countries through global usage of the dollar or that CPI numbers used to report inflation are inherently flawed, you cannot ignore the inflation hitting America over the past two years.

Looking through our dollar monetary policy lens, we see that the main culprit for this inflation is not timeless corporate greed or a European energy crisis that only began in the spring of 2022. The main culprit is clearly the unprecedented flood of dollars and credit that entered the market in 2020, which began coursing through the economy in earnest beginning with the widespread lifting of the COVID-19 panic in 2021.

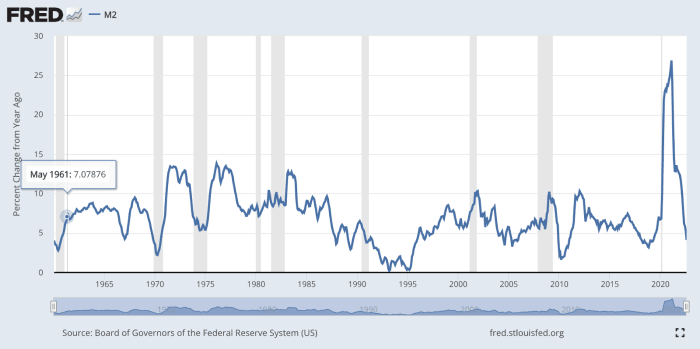

The total supply of dollars increased by 40% in just two years; 2020 and 2021. Source: Federal Reserve FRED

Within months, high inflation became a topic of concern among the population. This forced the Federal Reserve to the next phase of their roller coaster: raising rates.

Just eight months after the Federal Reserve began raising rates aggressively to curb inflation, cracks are beginning to show. Financial pundits are pointing to signs of impending financial calamity through increasing credit-default swap spreads on government bonds as well as major international banks such as Deutsche Bank and Credit Suisse.

In September, the Bank of England announced “temporary” purchases of its government’s bonds in order to “restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses,” (BoE). Buying bonds is an inflationary move — done in an environment of already high inflation.

With many fiat currencies heading for the drain and that value flowing into the dollar, our biggest crisis yet is brewing. Over the past 50 years each deleveraging event has grown in severity, from one sector to the whole financial system and now to entire countries and their currencies.

In light of the oncoming crisis, what will governments do to prolong the inherently broken monetary system that benefits the politically connected?

Dealing With Crisis

Each fall of the fiat roller coaster necessitates new tools to keep the system intact.

In 2008, interest rates hit zero for the first time and additional quantitative easing was needed to keep the financial system afloat.

In 2020, the Fed again put interest rates to zero and signaled a policy of “unlimited QE” just to quell panic and flight from the system. Alongside shutdowns mandated by government agencies, direct stimulus checks to every American as well as increased unemployment and housing assistance were necessary to stave off a massive deleveraging that threatened to take down the financial and monetary system.

All of these previous crises came at a time of relatively tame inflation. The upcoming crisis may be markedly different, since high inflation will make it difficult for governments and their central banks to print the currency necessary to avoid widespread economic collapse. Governments may turn to controls in order to manage inflation and dissent while preserving the existing financial system. These controls, potentially enacted using a CBDC — or government-operated bank account — could entail governments:

Money printing and price inflation need to continue to keep the existing system operational, and controls will arrive as the political answer to them. What can everyday citizens hold which will preserve value during monetary expansion while also remaining resistant to censorship and seizure by governments seeking to control how you transact?

What Bitcoin Was Built For

Bitcoin was not built to be a hedge against the broader market — after all, during a deleveraging caused by central banks tightening credit conditions, all manner of assets will be sold off in order to service debts. Where bitcoin shines is in preserving value across the arbitrary central bank monetary policy cycles, and in its power to resist controls.

The prices of real goods take time to reflect newly printed currency, while Bitcoin soaks up newly printed money immediately. While the money printers were on from spring of 2020 through the end of 2021, Bitcoin rocketed from around $5,000 to almost $70,000.

Instead of looking at bitcoin from the all-time high to its current price, let’s look at bitcoin’s growth in dollar terms from its previous cycle lows, after the massive deleveraging of the COVID crisis in March 2020. Even if we assume an investor scaled in from the time bitcoin trended between $5,000 and $10,000 in 2020, it returned 200%-400% to date. The S&P 500 returned around 30% over that time.

On top of pure appreciation against goods and services, Bitcoin offers security and privacy that are simply unmatched in any other monetary good. As a purely digital currency, you can store bitcoin with just your brain. This allows dissidents and refugees to evade and escape oppressive governments hell bent on confiscating or controlling how they transact. The Bitcoin network’s decentralized network of nodes and validators keeps the system running predictably for all users, with minimal risk of government or corporate interference to change those rules.

Bitcoin’s ability to capture value from an expansionary monetary system while also evading oppressive government controls makes it the perfect tool for protecting hard-earned savings over the long term during this moment in history.

The U.S. dollar system manufactures a business cycle that reallocates wealth from productive enterprises to political allies. Connections are more valuable than merit in a world where government funding — via central banks — is practically unlimited. Will you keep riding that painful roller coaster, or be a part of the solution?

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link