[ad_1]

While Bitcoin’s decline comes a day after Silvergate Bank revealed operational challenges, some seem to think that the nature of the crash was far too quick for it to be a direct result of the turmoil.

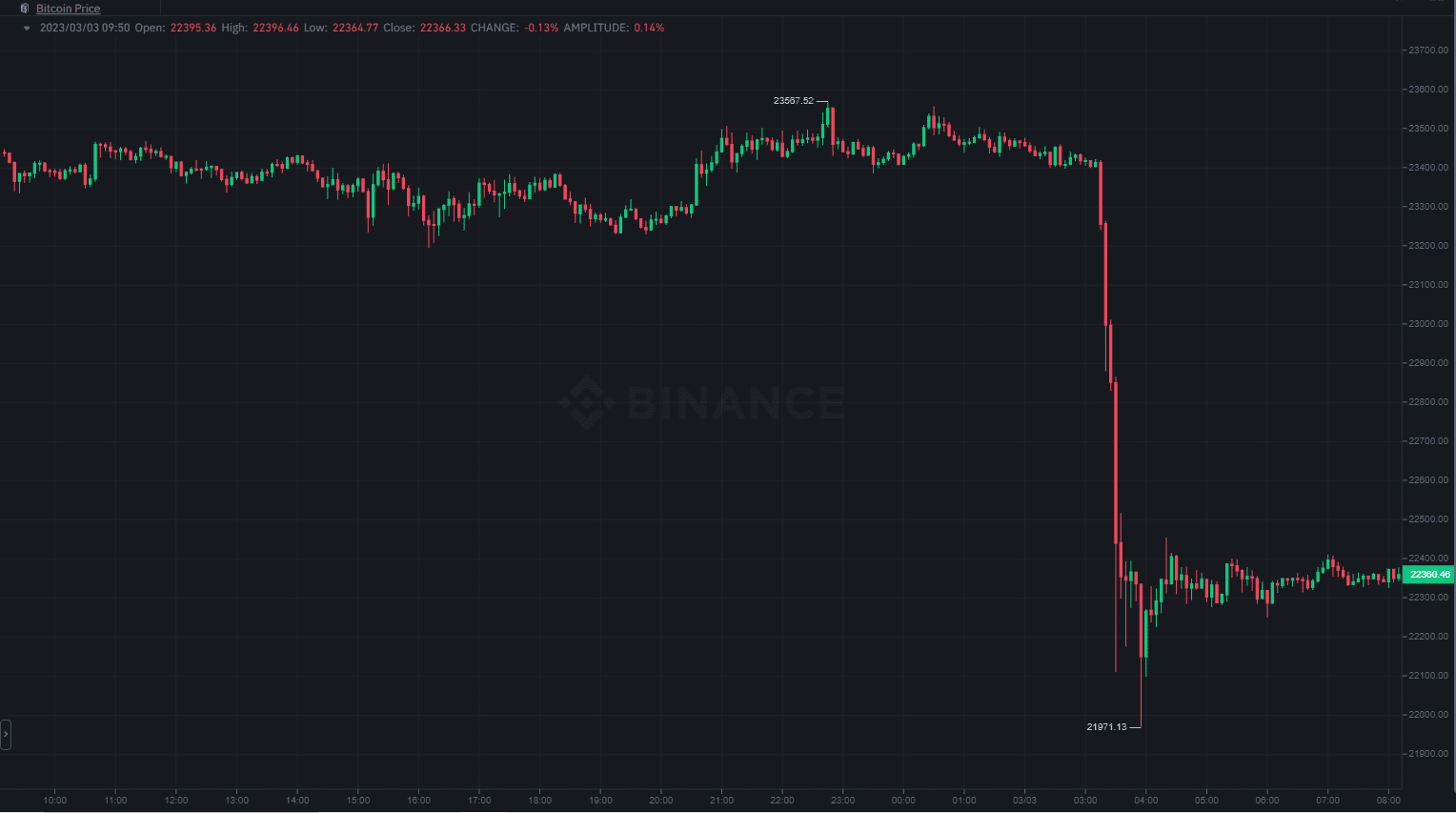

Indeed, the 5-minute chart reveals that the 5% crash happened in no more than 20 minutes.

- The move caused a considerable tick in the liquidations, which are currently standing at around $243 million across the board for the past 24 hours.

- And while the crash comes shortly after Silvergate Bank revealed a lot of operational challenges and many crypto companies abandoned ship, the nature of it seems off.

- Intra-day trader and creator of delta-based trading systems 52Skew took it to Twitter to clarify the reason for this particular crash.

BTC – well, no sharp squeeze up but sharp margin cascade here.

What led to this move is a large binance spot sale directly into an area of stacked up longs.

Margin call.

$BTC well no sharp squeeze up but sharp margin cascade here.

What led this move is a large binance spot sale directly into an area of stacked up longs.

Margin call pic.twitter.com/bkYRfCzkjS

— Skew Δ (@52kskew) March 3, 2023

The post Why Bitcoin’s Price Crashed to $22.2K in Minutes: Analyst appeared first on CryptoPotato.

[ad_2]

Source link