[ad_1]

This is an opinion editorial by Brooks Lockett, a freelance writer and Bitcoiner who fell down the rabbit hole in 2018.

Have you ever inspired someone to get into Bitcoin? What worked?

Have you ever accidentally repelled someone away from Bitcoin? What didn’t work?

The frustrating reality that 99 out of 100 people on the street still don’t “get” Bitcoin is driving a lot of Bitcoiners to conclude that there is no cure for Cassandra’s Curse other than time and patience. Cassandra’s Curse meaning that — despite the dangerously-close-to-collapse state of the fiat monetary system — the masses still haven’t discovered that a viable solution exists in Bitcoin.

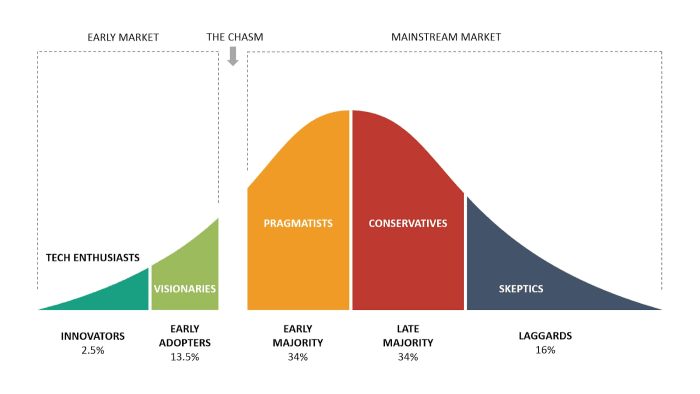

Yes, it’s early. Embryonic, in fact. But that shouldn’t mean we can’t create more vibrant conversations with those “pragmatists, conservatives and skeptics” who are unfamiliar with the Bitcoin ecosystem.

Close your eyes and think: How many conversations across the globe — online and offline — do you think happened in the past 24 hours where Bitcoin was mentioned?

Hundreds of teachable moments?

Thousands of teachable moments?

Tens of thousands of teachable moments?

Each of those moments represents an opportunity to properly apply persuasion and behavioral psychology to explaining Bitcoin.

Just because the person isn’t equally as receptive to a monologue about the Byzantine Generals Problem doesn’t mean they should “have fun staying poor.”

The fact that Bitcoin naturally challenges widely-held preexisting beliefs makes it especially vulnerable to the Backfire Effect. It’s up to the Bitcoin community to frame the technology in ways that aren’t perceived as unwelcome evidence or threats to their ideology.

Minimizing Bitcoin’s “Backfire Effect”:

In the Bitcoin community, we love distributed networks, Lightning channels, multisig setups, decentralization and the merits of a sound money standard.

The collective jargon, shared goals and shared values unify industry insiders who’ve spent years in the space. It’s fun to get together and say “hoorah!”

But outside the community — which is currently the vast majority of people on the planet — these are terms that might as well be a galaxy away.

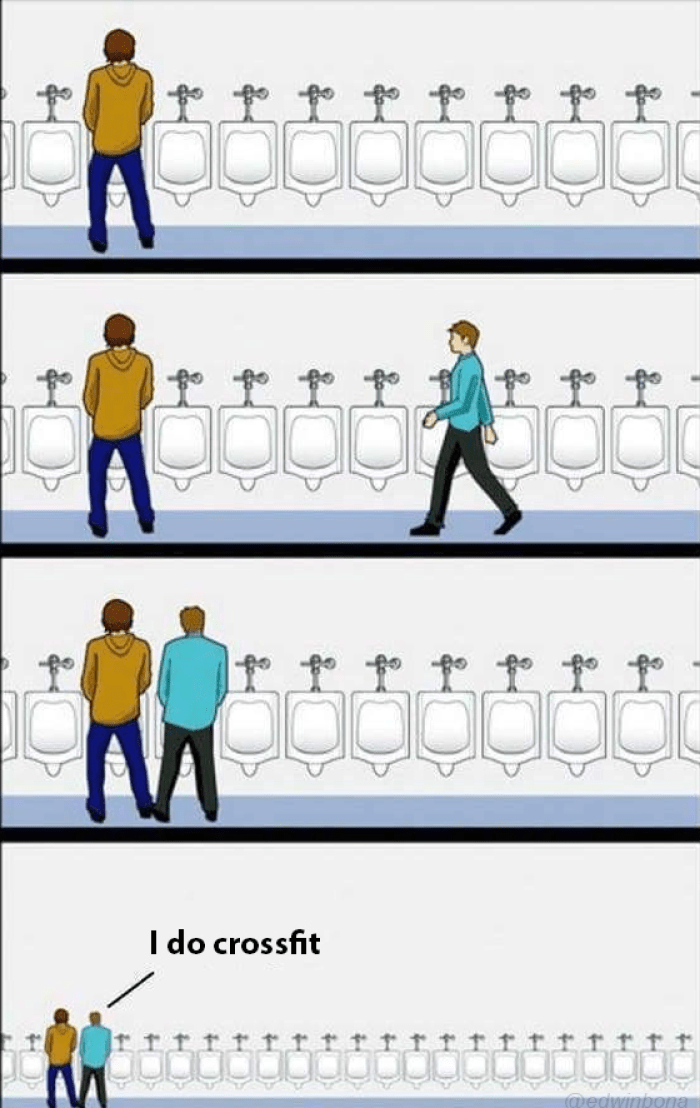

It’s not unsimilar to your jacked friend who really wants you to join his CrossFit gym. The fact that he looks fit and healthy is still not enough to get you to join.

Case Study: How I Got My Lawyer Friend Into Bitcoin

A good friend of mine is an intellectually-curious guy. He’s sharp, works in legal and always enjoys discussing economics, finance, politics, etc.

For years he’d ask generic questions in passing about Bitcoin because knew I was active in the space. And for years I’d try to give my most thorough, soup-to-nuts overview.

Each time I got the same subtle, discouraging, eyes-glaze-over reaction.

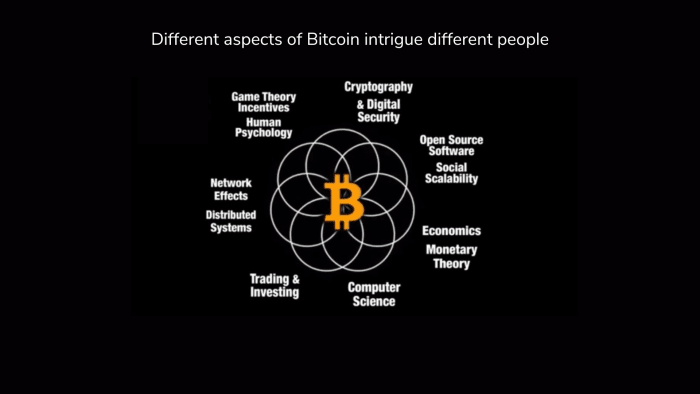

But one day I tried the inverse approach and sent the questions back his way. After some discovery I noticed all he wanted to talk about was Bitcoin’s potential role during wartime. Something we’d never discussed before.

I explained how a Bitcoin sound money standard could very well make wars significantly less affordable for authoritarian governments to finance.

I also walked him through how refugees who are able to memorize or hang on to their seed phrases can transport 100% of their net worth stored in the network with them while fleeing their countries.

Once he realized that Bitcoin is a universal language — a network that can be tapped into from anywhere in the world with 24 words — was what inspired him to do his own research and gravitate towards the space.

“Brooks, this is so obvious… why does this matter?”

I know. But had I gone on about mining, digital signatures or the importance of the software being open-source … I would’ve gotten the inevitable eyes-glaze-over moment, and we’d probably have one less Bitcoiner in the space.

What seems obvious in your head could be the light-bulb moment for another person.

If an opportunity comes up to discuss Bitcoin with a newbie, instead of jumping into an explanation of who Satoshi is, inflation graphs, or hash rate growth – I highly recommend starting with probing questions instead:

– “What are your opinions on the legacy financial system?”

– “Have you ever had a frustrating experience or delay with your bank?”

– “How large of an impact would you say the world wide web has had on the world?”

– “If you were in a position of high power, how would you go about making wars more difficult to finance?”

– “Do you feel as if your overall purchasing power has increased or decreased in the last decade?”

– “Would you consider yourself an early, middle or late adopter of new technology?”

Asking simple, but related questions will uncover the information you need to have a more vibrant conversation that helps build the other person’s knowledge base instead of reinforcing your existing knowledge base.

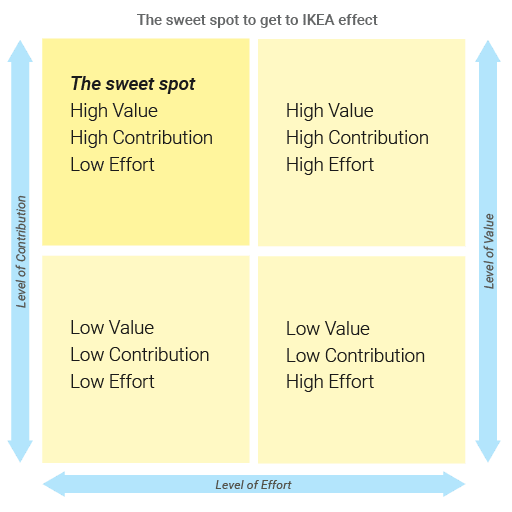

It’s the IKEA Effect in action: for the same reasons consumers place disproportionately high levels of value on products they’ve assembled themselves, people attribute more value to conversations where they’ve been an active participant in.

Let’s look at some example scenarios of how to get to the IKEA Effect.

The Counter-Productive Approach:

Other person: “Bitcoin is going to get shut down by the U.S. government.”

You: “That’s actually technologically unachievable. It’s a distributed network of computer nodes and if you don’t understand basic computer science then you’re not really allowed to have an opinion on this.”

Other person: “The government can shut down anything they want. They have the top hackers in the world working for them.”

You: “Whatever, you just don’t get it and you’re going to miss out on Bitcoin with that mindset.”

Net: Nobody wins.

The More Productive Approach:

Other person: “Bitcoin is going to get shut down by the US government.”

You: “I thought that at first too. You’d actually be really interested in it. Have you ever looked into distributed networks or cryptography before?“

Other person: “Not really. I’m not super tech savvy.”

You: “Would you say the separation of money and state is a good or bad thing?“

Other person: “I’d say it’s a good thing. Inflation is really doing damage and pricing younger generations out of society. It’s funny how much money older generations paid for nice homes with land versus what the situation is now. It’s honestly super unsustainable in my opinion, but I’m no expert.”

You: “Do you see that continuing or improving?”

Other person: “At this point, probably continuing.”

You: “What do you see as a viable alternative?”

Other person: “I’m not sure. Maybe you could explain to me how Bitcoin works?”

Net: Other person talks themselves into Bitcoin.

Of course, it won’t always be straightforward. But this simple shift in your approach can be the difference between a newbie spending 8 months of their life shitcoining instead of starting out Bitcoin-only in the first place.

Robert Cialdini discusses in his book “Influence: The Psychology of Persuasion,” which states that humans have a deep psychological need to be perceived as consistent.

How can we leverage this principle when explaining Bitcoin to others?

Doing the work to understand the other person’s specific context will lead to a lot less frustration than getting aggressive & annoyed when they fail to see Bitcoin from your perspective.

It’s the polar opposite of the high-pressure salesperson that jumps straight to the signature on the dotted line.

The best possible emotion you can invoke in someone when it comes to adopting new technology is curiosity.

Personal relevance is one of the biggest factors in those early conversations, says Joshua Guest, who provides Bitcoin education at The HiFi Bitcoin Letters. He explains, “There are few forces in the world that have a greater capacity to change individuals and society for the better than Bitcoin does. So helping new and veteran entrants to the space learn how Bitcoin can be personally relevant to them can have profound results.”

You’re already savvy with Bitcoin as a technology. Why not be equally as savvy at explaining it to newbies?

The higher our collective conversion rate as a community, the faster the network spreads, and the faster fiat dies.

Conclusion:

1. In Bitcoin, persuasion is better than force

2. Persuasive psychology is extremely complex, so the time to start experimenting heavily is now

This is a guest post by Brooks Lockett. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link