[ad_1]

Public mining companies are entering the final quarter of 2022 battered and bruised after nine months of bear market brutality. At the end of Q3, the total market values of all U.S.-listed mining companies dropped by over $14 billion from the start of the year, according to data compiled from YCharts. Whether the year’s end will offer a respite for these companies is a very open question as the headwinds from macroeconomic tumult seem unabated in the face of historic inflation and scrambling central bankers desperate for quick financial fixes. This article overviews the downtrend in share prices for public mining companies as the final quarter of the year begins.

2022 Mining Market Recap

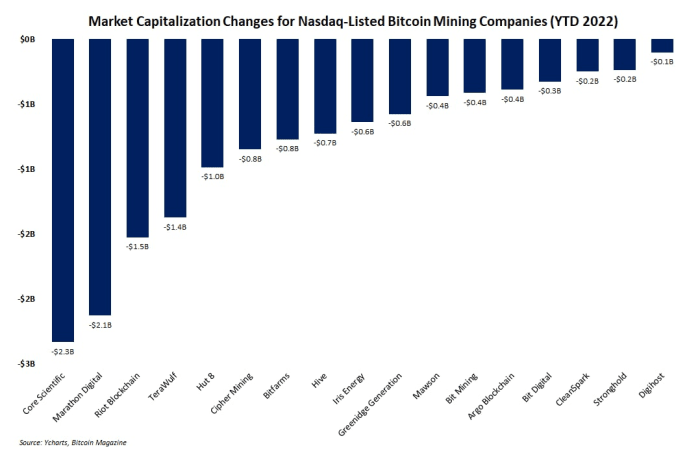

Over half of the total $14 billion erased from the market values of public mining companies is attributed to just five companies, according to data from YCharts: Core Scientific, Marathon, Riot, TeraWulf and Hut 8. The bar chart below visualizes each company’s change in total market capitalization from the start of Q1 to the end of Q3 of this year.

Compared to bitcoin itself, losses suffered by public mining companies are small. Since January 1, bitcoin’s total market value has slipped from $900 billion to below $400 billion at the end of September, according to data from TradingView.

Readers should know that these charts only show public mining companies that trade on American markets, namely the Nasdaq, one of the most liquid and actively-traded markets in the world. But other relatively high-profile public companies in non-U.S. markets have also suffered significant losses, including Northern Data and Cathedra.

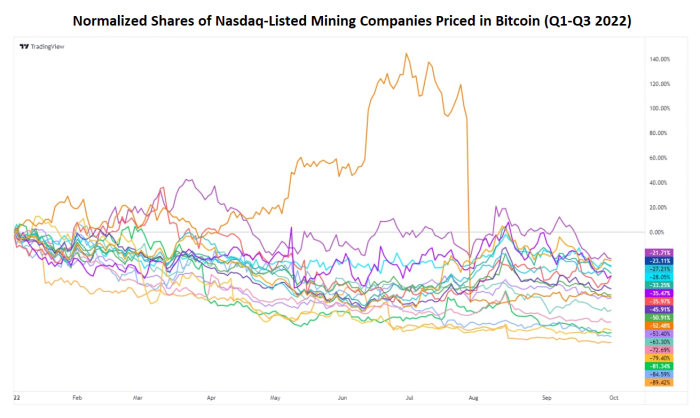

Any future price woes for mining companies depends completely on bitcoin’s price. Mining stocks are still closely correlated to bitcoin’s price, as this author noted in a previous article for Bitcoin Magazine, and continue to underperform. The line chart below visualizes share prices for all the mining companies included in the previous bar graph priced in bitcoin since the start of the year.

Bullish Hope Springs Eternal

Despite already being one of the longest and harshest bear markets in bitcoin’s history — especially for miners, as difficulty continues to soar to new heights while the price continues dropping — there is still hope for the public mining sector over the long term.

For one thing, so long as Bitcoin is bullish, bitcoin mining companies will also have a bright future despite intermittent periods of bearish market conditions. Even if some mining companies fail, others will take their place.

For another, even the traditional finance analysts see potential in the mining sector, with some analysts calling for “major upside” among public miners, according to CoinDesk, and others praising the “fantastic” fundamentals of some miners. And those fundamentals — for many companies — continue to improve. In September alone, for example, CleanSpark acquired a 36 megawatt site in Georgia, Aspen Creek raised $8 million to expand its solar mining, Rhodium plans to go public, and mining veteran Jihan Wu set up a $250 million fund for distressed mining assets. The mining sector is far from dead.

Opportunity From Immaturity

In many ways, the past couple years represented the very first market cycle for a significant share of the mining market, and nothing ever goes well during the first time roundtripping a market’s ups and downs. Losses will be suffered, valuations will plummet and some companies will collapse completely.

But winners always emerge from periods of market immaturity. And the public mining market’s immaturity is easy to see. For example, every mining stock’s price continues to move nearly in lockstep with bitcoin despite each company having enormous differences in operational strategies, outstanding debts, number of machines online, and more. This shows that the market cares more about bitcoin’s price than the company’s fundamentals. But this immaturity also means there is tremendous upside for growth and maturation. If that isn’t enough reason to make you bullish on mining, nothing will be.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link