[ad_1]

The battle for the future of Bitcoin is raging in real time on twitter as we are on the cusp of global economic contraction, thanks to 50+ years of the USD fiat regime, and are eagerly waiting for the approval of a spot Bitcoin ETF by the SEC. Yet, in the trenches on Twitter, the skirmish being fought is over what bitcoin is and how it should and shouldn’t be used. I covered this battle in some detail on Orange Label, but to summarize there are two camps in this battle: Monetary Maximalists & Blockspace Demand Maximalist. The big question is should inscriptions be a part of Bitcoin and how can they be stopped?

The purpose of this piece is not to sway you one way or another, but rather share some numbers that make the case that inscriptions will be priced out over time. Over the past year, we saw a doubling of BTC price and hashrate and during that time inscriptions caused some big changes in blockspace demand. We saw fees rise to a 4 year high as mempools were purging reasonable fees1, which means there were so many high fee transactions in mempools that lower fee transactions were being dropped from mempools. In other words, there was no chance for low fee transactions to be included in blocks. What started as a laughable novelty 12 months ago has brought in legions of new bitcoiners. This is an undeniable fact when you look up the number of reachable nodes on the network over the past couple years.

As bitcoin twitter has begun to divide on the topic, a meme has emerged suggesting that inscriptions will be priced out as NGU technology does its thing. This leads to the next logical question… at what point do inscriptions get priced out? That’s for the market to decide. For now, we can simply run the numbers and see how many dollars an inscription will cost as Bitcoin price appreciates.

The Calculator

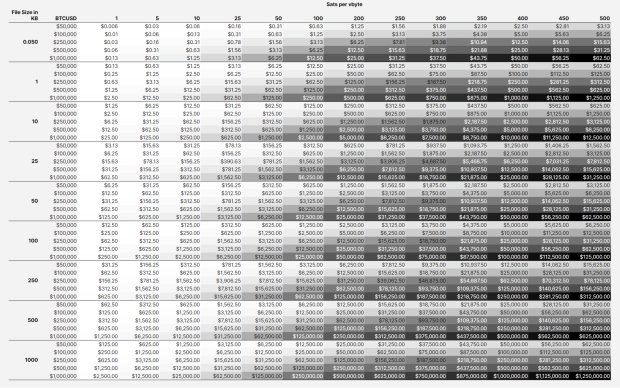

I am a big fan of table calculators23 and use them quite often when creating a story. For this piece I wanted to understand how much it would cost to inscribe a 100kb photograph at various prices. That then turned into asking how much these BRC20 shitcoiners are spending, and when will that nonsense end. These are around 50bytes or 0.05 kb in size for reference. I was able to track down4 a simplified formula for making an inscription:

Ordinal Inscription Cost Calculator Formula

Total USD Cost = ((((Inscription size in kb * 1000) / 4 * Fee Rate)) / 100,000,000 ) * Current BTCUSD Price

The important variables for this calculation is the file size in kilobytes, the fee rate in sats/vbyte, and the current BTCUSD price. With this little bit of information I was able to make a simple static table to see how different sized inscriptions will increase in USD cost as NGU for fees and BTCUSD.

This chart reveals much information and the big takeaway for me is just how expensive it will be to put data in blocks in the not too distant future. Let’s take our 100kb image example. At current fees around 100 sat/vbyte and $50,000 BTCUSD that will cost $1,250 to inscribe. That is a big pill to swallow. Now let’s examine the shitcoin token BRC20 that’s used for money laundering… It is around 0.05kb in size. ‘At current fees around 100 sat/vbyte and $50,000 BTCUSD that will cost $0.63 to inscribe. That is a small amount, but these things are being inscribed by the truckload. We are talking collections with 1m units. So not a small amount and there is not a single BRC20, there are tons popping up. The question about the liquidity for these things is for a different post.

As you move down the chart to higher BTCUSD prices for each inscription size, you can see just how ridiculous things become. Our humble 100kb jpg will cost $62,500 to inscribe when BTCUSD hits $1m and 200 sat/vbyte. Similarly the same BRC20 would increase to $25 for a single token. These kind of prices start to price out the really dumb like monkey pictures and memecoin shitcoins.

As you can see, these inscriptions production cost increases linearly with BTCUSD increases. This alone will price out large portions of the market, however you must ask yourself as the overall market size increases, that will bring new entrants who will drive additional demand, in other words the pond will get bigger and the fish will get bigger, the small fish just won’t get to eat.

What to expect?

Thinking through what happens next is tough, as there are many plausible outcomes but the one I am coming back to is the meme that I mentioned at the start of this article, inscriptions will be priced out. Just run the numbers, they don’t lie. I don’t think we are anywhere near inscriptions dying in the short term, but there will come a point in time where it is just too expensive for dumb things to exist on chain. Low time preference activities will prevail.

I see the overall inscription ecosystem continuing to evolve and that means people’s minds and opinions will continue to change too. We are seeing thoughtful commentary from devs5 warning6 of how changing the protocol to address or eliminate inscriptions usage will only push people to “exploit” other parts of the protocol for it’s precious blockspace. We are seeing novel new ways to crowd fund inscriptions and incentive the seeding of data via bitcoin + torrents such as ReQuest, Durabit, and Precursive Inscriptions. Inscriptions are a thing, blockspace is precious, and people are willing to pay for it. Bitcoin is for enemies, and it is going to get weird(er). Cope and seethe but remember to have fun.

- Reasonable is subjective, markets clear. I believe I saw transactions with fees as high as 20 sat/vbyte being purged, which in recent memory feels absurd. ↩︎

- Demystifying Hashprice ↩︎

- Satsflow Scenarios ↩︎

- Someone made this and it is pretty handy. I used this formula to build out my table in google sheets. https://instacalc.com/56229 ↩︎

- “Concept NACK.

I do not believe this to be in the interest of users of our software. The point of participating in transaction relay and having a mempool is being able to make a prediction about what the next blocks will look like. Intentionally excluding transactions for which a very clear (however stupid) economic demand exists breaks that ability, without even removing the need to validate them when they get mined.

Of course, anyone is free to run, or provide, software that relays/keeps/mines whatever they want, but if your goal isn’t to have a realistic mempool, you can just as well run in -blocksonly mode. This has significantly greater resource savings, if that is the goal.

To the extent that this is an attempt to not just not see certain transactions, but also to discourage their use, this will at best cause those transactions to be routed around nodes implementing this, or at worst result in a practice of transactions submitted directly to miners, which has serious risks for the centralization of mining. While non-standardness has historically been used to discourage burdensome practices, I believe this is (a) far less relevant these days where full blocks are the norm so it won’t reduce node operation costs anyway and (b) powerless to stop transactions for which an existing market already exists – one which pays dozens of BTC in fee per day.

I believe the demand for blockspace many of these transactions pose is grossly misguided, but choosing to not see them is burying your head in the sand.” – Peter Wuille Link ↩︎ - “Ever since the infamous Taproot Wizard 4mb block bitcoiners have been alight, fighting to try and stop inscriptions. Inscriptions are definitely not good for bitcoin, but how bitcoiners are trying to stop them will be far worse than any damage inscriptions could have ever caused.” – Ben Carman Link ↩︎

[ad_2]

Source link