[ad_1]

A few days ago, I have been reading Li Xiaolai’s “Self-cultivation of Leeks”. The title of the book is very playful. After reading it, I have some gains.

Li Xiaolai has mixed opinions on the Internet. ChuxiaoLian has been in the crypto circle for too short a time. I am just a little leek and don’t know much about his deeds, but as a newcomer to the circle, these three ideas are quite beneficial.

1. Only invest in the targets that most people in the market are optimistic about.

Whether it is the stock market or the crypto market, as a novice, it is indeed difficult to find high-quality projects, and it is difficult to know which one is likely to bring ten times the returns.

The crypto market fluctuates greatly, and many information are time-sensitive. Newbies are not well informed. When they see the news, it is basically the end, and the risk of chasing high is extremely high.

For beginners entering the crypto market, it is better to only focus on trading TOP1–2 projects, which are all screened out by the market. Instead of buying unreliably, the novice should follow the judgment of most people in the market and only invest in leading projects.

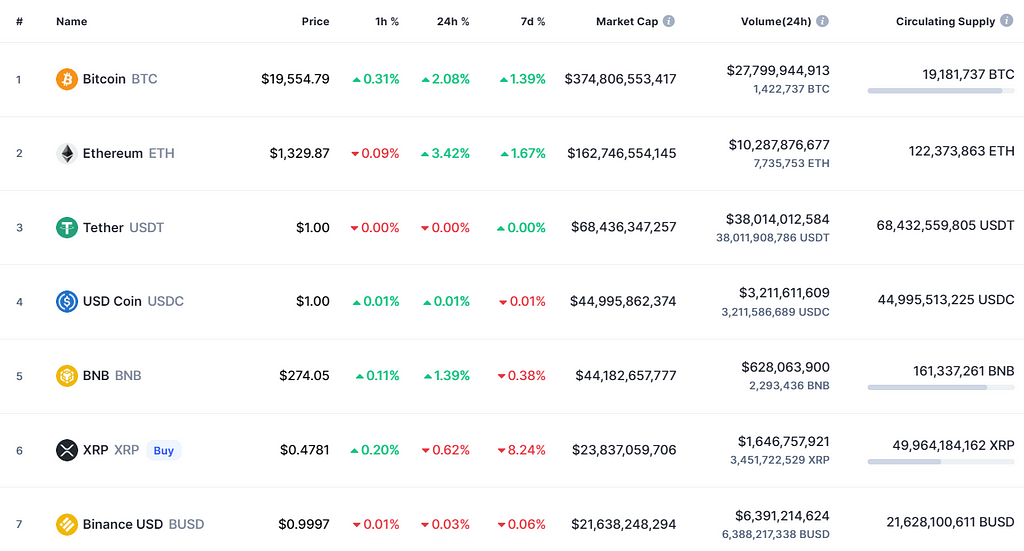

For example, through the data platform, you can check which ones have the largest market capitalization and the most liquidity, and choose the top 1–2 industries. Even if they return to zero, they will not be so fast. It is impossible to have a 100-fold chance one day, and it will not be zero in 5 minutes.

2. The market has cycles.

Most of the newcomers are late and ready to enter the market when they see that Bitcoin has risen to 69k and hear that Dogecoin and shitcoin are out of the circle. At this time, it is already the end of the crazy bull market, and entering the market means being caught. stuck.

Sure enough, after the carnival in mid-November last year, Bitcoin continued to fall from 69K to 19K today, dropping $50,000, a drop of more than 72%.

According to market fluctuations, if you invested $1,000 to buy Bitcoin last year, there is only $275 left in value; if you buy other altcoins, most of them have already returned to zero.

The bear market has no wealth effect, the market is sluggish, most people leave the market, and the media has not reported it. Now is a new round of troughs, and perhaps the starting point of a new cycle.

But most people can’t see skyrocketing and out-of-the-circle projects, let alone market opportunities. The path of most people is to enter when there is a lot of people, and leave when no one cares, so most people lose money.

If a novice wants to gain something, he may have to deviate from path dependence, choose a path less traveled, and follow the cycle to do the right thing.

3. Reduce the frequency of transactions and improve the strength of OTC principal accumulation.

Some people continue to make trades and swings. Although they have gained something, if they step short once, they will be bound by the market.

Newcomers can’t understand and respond slowly, so it’s better to reduce the frequency of operations. If you don’t understand, don’t vote. You hear about ten times the chance, most of which are bait, just fooling you to take the offer.

Most of the reported stories of getting rich are all about which target to vote for, and how many years have been forgotten, the result has increased many times; of course, there are also many projects that have all returned to zero after many years.

Only by placing it in a longer market cycle and avoiding frequent buying and selling can it be possible to wait for the last chance; this premise is to invest in projects that have been favored by the market and benefit from the general trend.

The market is the same market, some people are allin the quilt in the last bull market; some people switch back and forth in the altcoins of 100 times, passively returning to zero; some people run out of contracts and quietly leave the market.

There is also a new round of people who want to find out in the market. No matter which phalanx player you are, you must study more and find a way to play that suits you.

The above is just my personal opinion, no investment advice. I’m ChuxiaoLian, and I’m following the metaverse and web3.

New to trading? Try crypto trading bots or copy trading

How do new players in the crypto market accumulate a BTC? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link