[ad_1]

This is an opinion editorial by Dillon Healy, a member of the institutional partnerships team at Bitcoin Magazine and The Bitcoin Conference.

A topic that has received increased attention lately is the concern around Bitcoin’s future “security budget.”

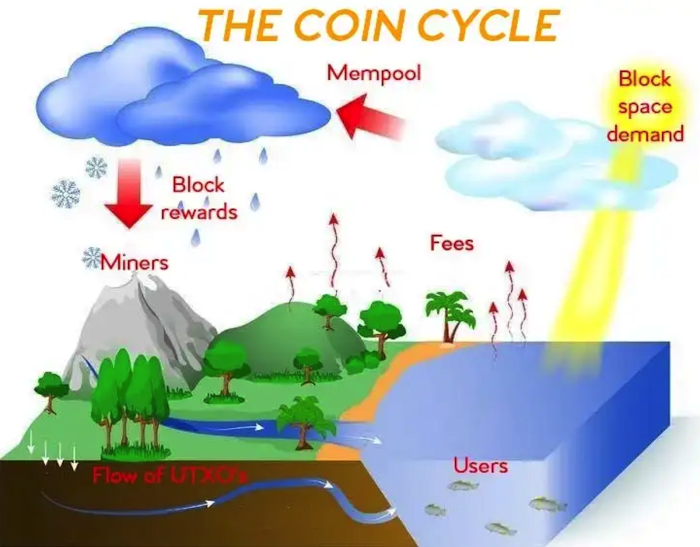

This mainly stems from the worry that miner revenue will not be enough to offer adequate security in the future, post block subsidy. Bitcoin miners play a crucial part in securing the network by proposing blocks of transactions which nodes then verify, accept and update to the Bitcoin ledger. Competing against other miners to propose this new block to the chain, miners use intense computing power to complete the proof-of-work consensus algorithm, and win the right to propose the new block.

For this service, the winning miner receives a block reward, which is made of two components: the block subsidy and the transaction fees. The block subsidy is the amount of new bitcoin minted in each block (currently 6.25 bitcoin), this subsidy of new bitcoin released from the total supply of 21 million is cut in half about every four years with the halving. The block subsidy currently makes up the vast majority of total miner revenue.

Simplified, the concern is that the transaction fee portion of the miner rewards will not be raised enough to make up for the loss of the block subsidy, resulting in decreased security for the Bitcoin network and an increased likelihood in attacks as miners are no longer incentivized to participate. My view, though, is that most who are worried about this are misunderstanding Bitcoin’s long-term game theory, incentive mechanisms, scalability and adoption potential.

With that being said, this is a topic that should probably be discussed more publicly and not shrugged off as a non-issue. There are people advocating for tail emissions to be added, creating an increase to Bitcoin’s 21 million supply as a solution to the security budget (settlement finality) issue, which is concerning.

I believe the solution (if you can call it that) is already baked into the Bitcoin incentive structure and adoption curve. There are two parts: one, transaction fees scaling with Bitcoin adoption and as a security measure and two, Bitcoin mining transitioning to an auxiliary tool.

Transaction Fee Scaling

When this issue is raised, it usually comes from somebody with a misunderstanding of how or why transaction fees will increase or advocating for proof of stake (here’s an example). Ironically, one of the reasons for increased transaction fees could be a natural defensive reaction to an attack from a bad actor mining empty blocks to prevent users from transacting. If empty blocks are being mined, the mempool will fill with Bitcoin transactors that are raising fees, competing with each other to get in the next block. Riot Blockchain and Blockware Solutions released an incredible report outlining how this and similar attacks would be met with naturally-occuring defense mechanisms from the Bitcoin immune system, most resulting in much higher transaction fees:

“Under an empty block attack or other attacks attempting to stop users from transacting, it is in the self-interest of Bitcoin users to raise their transactions’ fees to get into the next block. The more empty blocks (the longer the attack lasts), the more pending transactions in the mempool. Transaction fees could soar from 1 sat/vbyte to 1,000+ sats/vbyte. The reward for one block could go from close to 0 BTC to 10+ BTC assuming the current maximum block size of 1,000,000 vbytes. The system is antifragile, and an empty block attack would be met by an endless market based counterattack of high transaction fees. And knowledge of this counterattack would likely deter the attacker from this attack in the first place.”

Another example of fees raising as a result of the network defending itself would be a reaction to miners attempting to censor merchants. This example is covered more in depth in this article:

“If a majority miner is not accepting transactions from merchants then the censored merchants must either increase their fees or not transact at all. If a merchant cannot move their bitcoins then they effectively have no value for the duration in which they are being censored. We can deduce that, due to personal time preference, a merchant who is being censored will be willing to pay a higher confirmation fee proportional to the duration in which they are being censored, up to the theoretical maximum in which the fee is the entirety of the transaction.”

In addition to naturally-occuring defensive incentives that would result in increased transaction fees, there are also countless arguments for transaction fees increasing as a result of Bitcoin adoption, specifically as a medium of exchange.

As adoption increases, competition to add transactions to Bitcoin’s scarce block space will increase, and this increases current fees, which then creates further demand for scaling solutions. The market will continue to present these scaling solutions as demanded — some popular solutions now include exchanges batching transactions, the Lightning Network and other Layer 2 and Layer 3 developments that can ultimately bundle thousands of Bitcoin transfers into one transaction that settles on-chain.

When you understand Bitcoin’s adoption curve, it is completely reasonable to assume that the majority of normal user transactions will occur on additional layers or sidechains. Final settlement of these more efficiently-bundled transfers will occur on-chain, along with transactions that want increased security or institutions moving large values. The final settlement would warrant a much higher transaction fee.

The second route that should lower concern around miners dropping offline and reducing the overall security of the network is increased efficiency and a newer realization that Bitcoin miners can act as an auxiliary tool for other business practices. A highly-overlooked development in the mainstream lately has been the Bitcoin miners’ incentive to pursue stranded, wasted or excess energy.

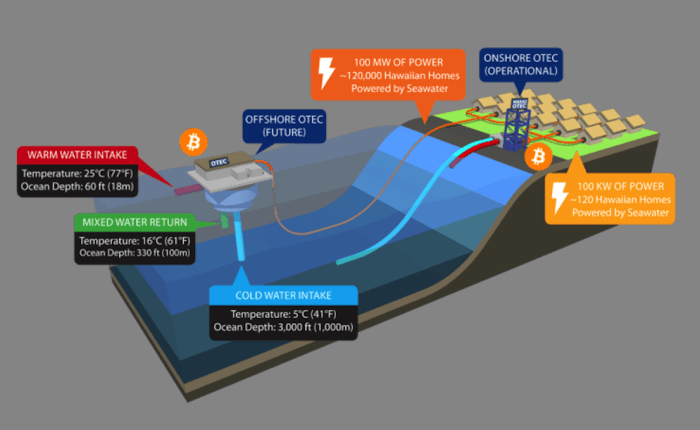

Bitcoin mining offers a unique and new proposal for society, where untapped or un-transportable energy can now be instantly sold to the Bitcoin network on-site via mining. One of the most interesting innovations in this sector is ocean thermal energy conversion (OTEC) merging with Bitcoin.

There is an incredibly in depth article on how OTEC and Bitcoin can further energy production and efficiency here:

“Bitcoin has the potential to help unlock between 2 to 8 terawatts of clean, continuous and year-round baseload power — for one billion people — by harnessing the thermal energy of the oceans. that turns Earth’s oceans into an enormous renewable solar battery.

“It does this by combining warm tropical surface water and deep cold seawater to create a conventional heat engine. This simple idea is perfectly suited to be expanded to a planetary scale by Bitcoin’s unique appetite for purchasing and consuming stranded energy from the prototypes and pilot plants that will be required to prove it works. Furthermore, by harnessing virtually unlimited quantities of cold water for cooling co-located ASIC miners, OTEC may very well be the most efficient and most ecological way to mine Bitcoin.”

This is just one example of how mining can become even more efficient over time, and with increased efficiency comes continued network security as it makes less sense for miners to go offline.

Image source: Makai Ocean Engineering

Bitcoin mining is also now becoming an auxiliary tool for other industrial processes. Bitcoin miners can pair with different industries and businesses and offer enormous benefits to seemingly-normal business practices. One mind-blowing example: ASICs used to mine Bitcoin generate heat, this heat can be used to boil water and create steam, condensing the water again is a form of purification, and ultimately this can result in water distillation that was subsidized by mining, as was discussed in a recent Troy Cross interview.

These ASICs that generate heat also need to be cooled with fans. Another mind-blowing concept is combining mining with businesses or industries that naturally create cool air. An example that Cross discussed was carbon capture facilities, which integrate enormous fan banks as part of their normal business operations. Pairing these fan banks with a mining operation subsidizes the cost of ASIC cooling.

As these innovations get more developed, simply adding Bitcoin mining to countless unrelated industries and businesses that generate cooling or need heating will improve efficiency and reduce costs. Bitcoin mining is already heating greenhouses and distilling whiskey, while at the same time monetizing stranded or wasted energy.

Over time, Bitcoin mining will continue to be paired with industries that make mining or normal business operations more profitable. Eventually it will be ridiculous to not use your businesses’ naturally-generated heat or wasted energy on Bitcoin miners, or if your business happens to have enormous fan banks, it will become ridiculous to not point them at ASICs. All of this results in more positively-incentivized miners over time which maintains network security and has the potential to counterbalance the shrinking block subsidy.

The combination of Bitcoin’s adoption naturally leading to increased transaction fees over time and Bitcoin mining shifting into an auxiliary tool for a wide range of independent industries demonstrate how the long-term security of the network is something to be optimistic about.

This is a guest post by Dillon Healy. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link