[ad_1]

This is an opinion editorial by Aleks Svetski, author of “The UnCommunist Manifesto,” founder of The Bitcoin Times and Host of the “Wake Up Podcast with Svetski.”

Bitcoin is the perfect money. It embodies all of the properties and functions of money:

- Store of value (SoV)

- Medium of exchange (MoE)

- Unit of account (UoA)

…and does so in a way that any person or participant, from anywhere in the world can:

- Save without having their wealth invisibly stolen

- Spend without some Big Brother type of institution telling them what or with whom they’re allowed to do so

- Account, audit and verify what they have, when they received it and how much it is in relation to the whole.

Furthermore, this is all possible without any form of trusted intermediary, government regulation, prudential oversight or “decree by the anointed.”

Money is arguably the most important invention of mankind because it is a social technology, and we are by definition the social species. Money is the mechanism by which we measure or attempt to quantify complex things in both the material realm, such as time, energy and material resources, alongside things that are more metaphysical in nature, such as “value,” “reputation” and “quality.”

As a result, money is not just a “measuring stick,” but is also a communication network. It is a medium through which higher order collaboration is made possible.

Money is critical for the formation of any society more complex than a few hundred people and without it we simply cannot scale civilization up. There’d be no division of labor nor any form of production beyond self subsistence.

Now, here we are in 2022. Roughly 14 years since Satoshi Nakamoto released the white paper for what has emerged as the apex money (at least on this planet).

So, what does this have to do with Bitcoin’s circularity?

Well, if bitcoin is the next and final global money, then by definition (and by design) it is already circular. It’s a monetary unit and a financial network which already embodies all of the elements required for a global economic system.

So, it’s not a question of “if,” or even “when,” but more a question of progress, magnitude and necessity.

In 2020 I wrote an article entitled “Bitcoin & Lockdowns,” in which I put forward a model of understanding Bitcoin’s long-term adoption curve, through the lens of necessity. And this is the answer to the circularity question:

When circularity? —> “As it becomes more of a necessity.”

“Necessity is not only the mother of all invention, but is the grandmother of all change.”

Major transformations like Bitcoin are progressions which diffuse through society in memetic fashion.

They start imperceptibly slowly, but as they gain momentum due to both their own development and the deterioration of the old guard, they begin to accelerate exponentially.

And this is what we’re in the midst of today:

The fiat experiment spiraling out of control, and the necessity of using Bitcoin as a savings vehicle, payments mechanism and at some point an accounting system, all rapidly accelerating and converging.

When you look at modern economics and the fiat money they’re dependent upon, you realize you can no longer:

- Accurately measure the product of your labor or value generated in the marketplace

- Store or preserve the product of your labor or value generated in the marketplace

- Freely or voluntarily exchange the product of your labor or value generated in the marketplace

Money is no longer “money” in the true sense of the term. It’s become, as Stephanie Kelton would put it; just “points.”

It has become meaningless, virtual, arbitrary, pointless points which one group can make up at the expense of all other players in the game. And who are those players in the game? Well — it’s the rest of us, our livelihoods and of our scarce natural resources.

This is a model of the world that cannot last, in much the same way as the fool who jumps off a cliff attempting to fly thinks he’s beaten gravity for the first few seconds as he’s moving upwards.

When we extend the timescale a bit, we’ll find that gravity catches up. It always catches up.

Another example is the entire KYC/AML edifice, and the ridiculous new mandates like the “Travel Rule.”

Money exists so that two parties who do not know each other can exchange the product of their time and labor, for things each subjectively values more or less. “Knowing your customer” is fundamentally antithetical to the entire raison d’être of money and the scale it’s supposed to enable in society via efficient trade.

Imagine all of the wasted resources that go into:

- Unnecessary compliance

- Knowing all of your customers

- Reporting meaningless statistics for AML

- Licensing and regulations

- Bureaucratic negotiations and lobbying

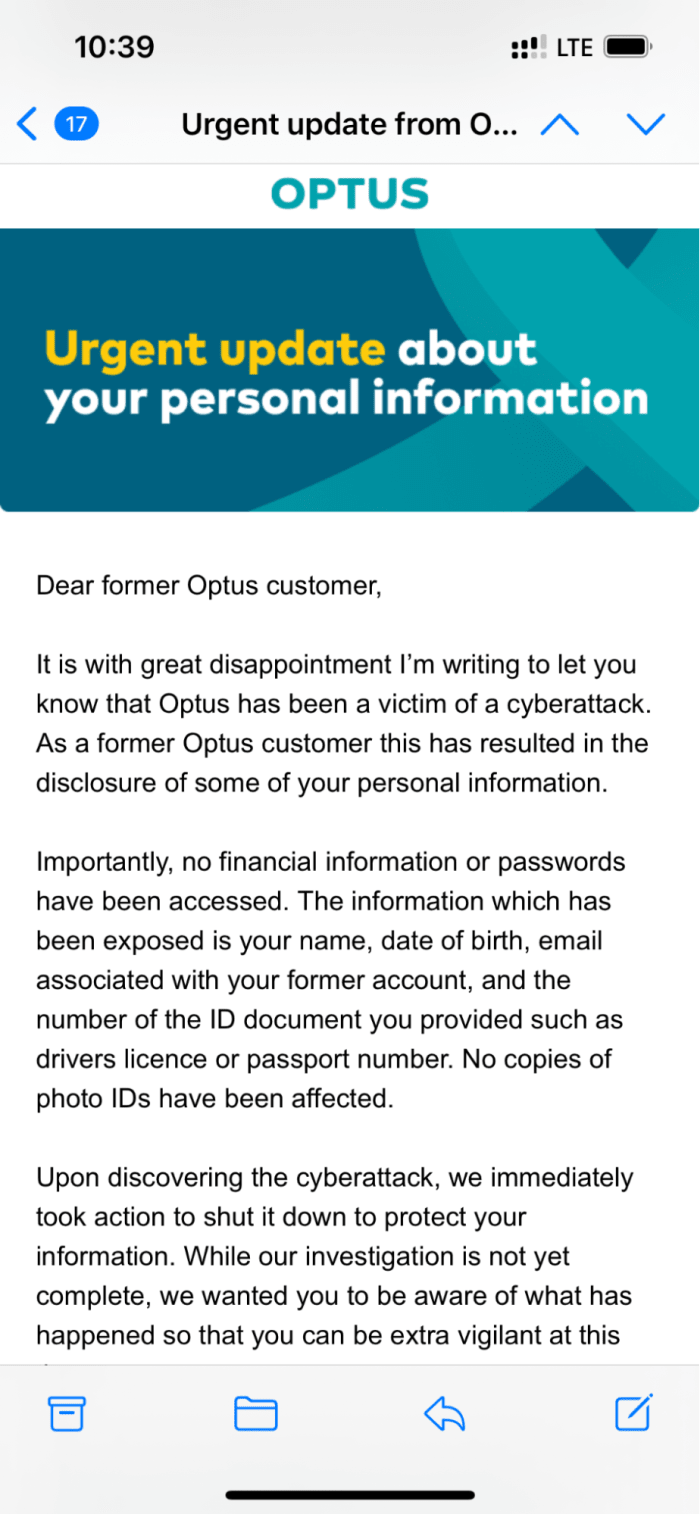

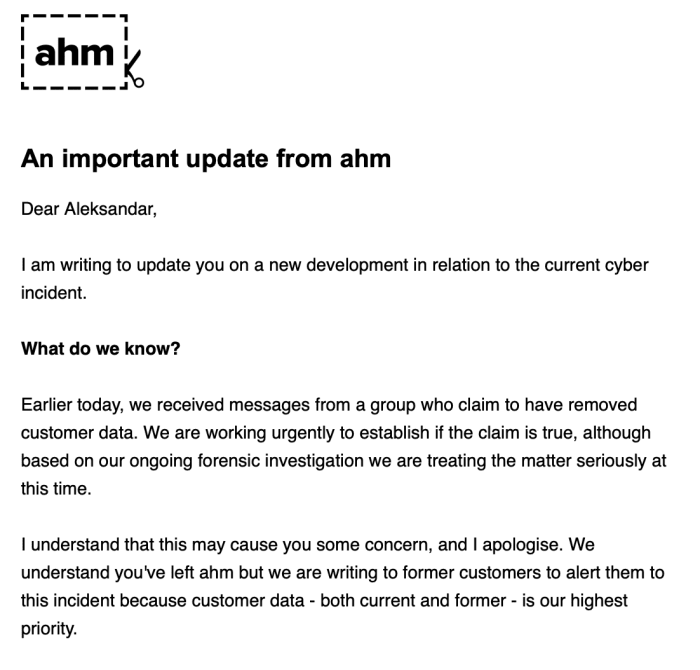

Imagine how much more effective we could all be and how many resources we could save and allocate toward productive means if we were not forced to play this game. And to add insult to injury, think about how much privacy this entire “performance” compromises on the part of all “customers” involved. See these two idiot companies in Australia, within a week of each other recently:

It’s crazy.

Payments and financial privacy will not get better under the existing system. They’re only going to get worse.

Savings will not be protected under the existing regime. They will only continue to evaporate.

This is all why Bitcoin’s necessity as the foundation of a new monetary and payments network is only going to increase, as will the magnitude of its circularity.

There Is No Alternative.

It will be driven just as much by the decline of the existing fiat system, as the zero to one evolution of money that Bitcoin represents.

Incompatibility

One of Bitcoin’s most important and, for many, compelling features is incompatibility, specifically with the status quo or legacy money and payments.

Bitcoin is fundamentally unlike anything that currently exists and it is therefore by definition circular. Bitcoin can really only move over the Bitcoin Network. Any bitcoin that looks as if it interacts with the legacy system or perhaps even other “crypto networks” is just paper bitcoin.

Bitcoin is only truly recognized on the Bitcoin network, and vice versa: the Bitcoin network is only useful insofar as bitcoin can be moved on it. Bitcoin can only live on the Bitcoin network.

What more circularity can you ask for? This is not some interoperable shitcoin, or an exchange à la FTX or BlockFi, or some digital database with points. This is an entirely different beast that few understand, especially those who are arrogant or stupid enough to think they’re somehow larger or more significant than Bitcoin itself.

Bitcoin is as different to every other form of payments and money as the internet is to the flag communication system created by Genghis Khan almost 1,000 years ago.

It is a complete paradigm shift. It is a zero-to-one discovery and invention.

Zero To One

It’s worth noting that zero to one transformations are not always seen as “improvements” in the beginning, especially with respect to networks. They’re fundamentally different and require input and energy from the participant, much like the activation energy in a chemical reaction. But as new “catalysts” emerge, and different participants find themselves “energized” enough to change (as the necessity arises), the movement cascades, achieving both mass and scale, and we look back to wonder how we ever lived without it.

This is how we’ll all look back on Bitcoin decades from now.

Future generations that are free to transact globally, instantly and securely with a money that’s always on and incorruptible will look back on this period of fiat history and wonder how some could’ve ever been stupid enough to think Stephanie Kelton economics, where 2 + 2 = 435, would last.

In much the same way that we now take things like electricity for granted, or the internet, or Uber or social media, for that matter, we too will take Bitcoin for granted. People laughed at the early electricity pioneers, whether it was Nikola Tesla, George Westinghouse or even Thomas Edison. They couldn’t fathom what we’d need to use this mysterious power from God for, other than, perhaps, lights.

The internet was the same. The “greatest minds” of the time couldn’t imagine far beyond a fancy video and conferencing call medium. Some saw the potential for online shopping, but that was it until about two decades in. Now it forms the backbone of almost every major industry and artery of modern civilization.

I could go on, but I think you get the point.

In closing, to understand Bitcoin’s circularity, you need to look at Bitcoin’s holistic functionality, through a lens of necessity and time, and you need to get a feel for the incompatibility or paradigmatic shifts that occur with a zero-to-one types of discoveries or innovations (Bitcoin being a blend of both).

Bitcoin wins in the end because it has time on its side. Bitcoin is where the puck is going.

The legacy system loses because it is fighting a losing battle against entropy, and every move it tries to make to save itself is actually a move toward killing itself. The legacy system is where the puck was.

It’s over for fiat. It’s just going to take what seems like a long time to any one individual, but what’s really a very, very, verrrrry short time on a civilizational timescale.

What a time to be alive.

This is a guest post by Aleks Svetski, author “The UnCommunist Manifesto” and founder of The Bitcoin Times. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link