[ad_1]

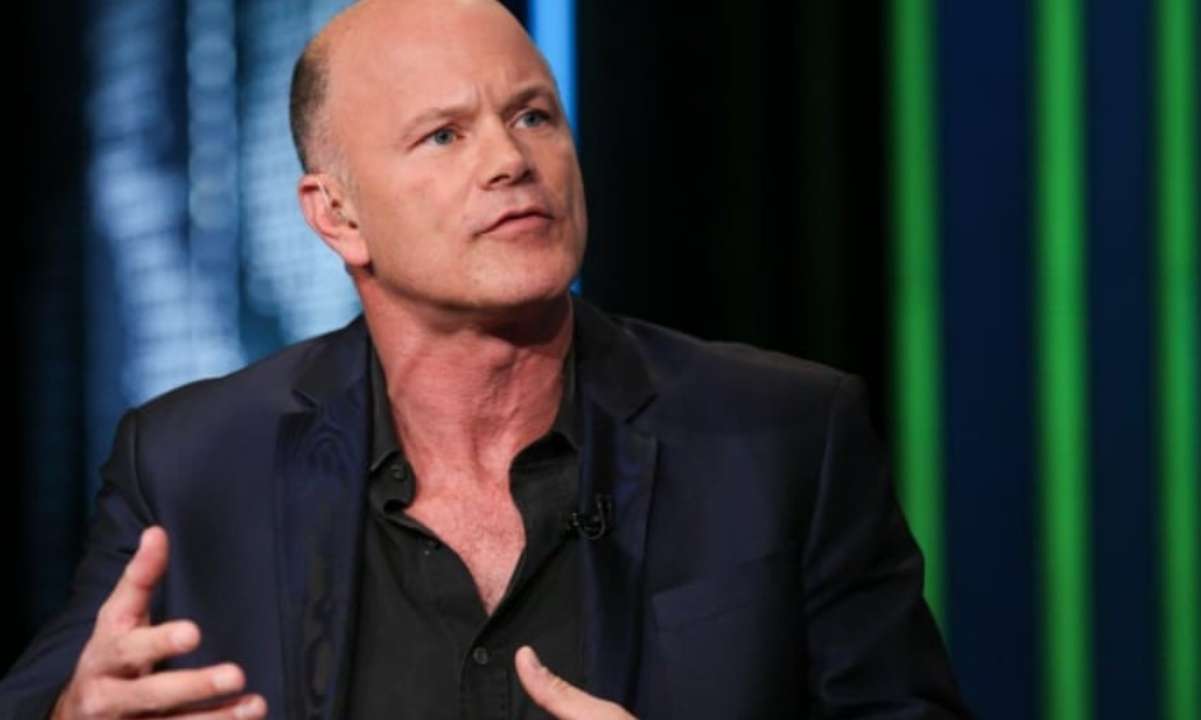

Mike Novogratz – the CEO of Galaxy Digital – opined that China’s less hostile stance on the crypto industry could be one reason behind bitcoin’s possible price increase in the next several months.

The Hong Kong subsidiaries of some leading Chinese banks have recently offered their services to local cryptocurrency businesses.

Novogratz’s Bullish Forecast

The American investor believes certain factors could trigger a further price rally for the cryptocurrency market. For one, he argued that “all the selling that needed to get done was done.”

Recall that the countless adverse events in the sector last year, including the Terra crash, the 3AC bankruptcy, and the FTX meltdown, hampered investor interest and caused many people to part with their holdings.

Another bullish indicator could be the positive winds coming from China. Beijing has recently given its green light on the crypto developments happening in Hong Kong, while the Bank of China, the Bank of Communications, and the Shanghai Pudong Development Bank have already started offering their services to domestic digital asset entities.

Novogratz thinks the crypto market could surge “substantially” in the following months should the trend remains the same. He also predicted that bitcoin could tap $30,000 by the end of this month.

While highlighting the efforts of the Chinese banks, the businessman regretted that the American regulators have recently tightened the noose on the crypto universe:

“It’s not good for America’s chance to lead this industry. It’s pushing people offshore, and so we’re fighting back,”

Earlier this week, the US CFTC filed a lawsuit against Binance for allegedly violating trading regulations. Prior to that, the SEC probed Kraken over a possible sale of unregistered securities.

Refuting Steve Hanke

The prominent economist and a well-known critic of the crypto industry – Steve Hanke – had another go recently, describing bitcoin as “a highly speculative asset, not a currency.” He added that it lacks stability and could be used in scams while buying it is “a fool’s game.”

Novogratz disagreed with the comments, urging Hanke to look at BTC’s performance during the past two-three years, when “it’s been safer” than the shares of the banking giant – JPMorgan Chase & Co – and the tech behemoth – Google.

Steve it has outperformed all assets ytd, over 2 years and 3 years on a risk adjusted weighting (sharpe ratio) It’s been safer than JPM and Google. Run the numbers yourself. https://t.co/uA15XaoUTo

— Mike Novogratz (@novogratz) March 28, 2023

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

[ad_2]

Source link