[ad_1]

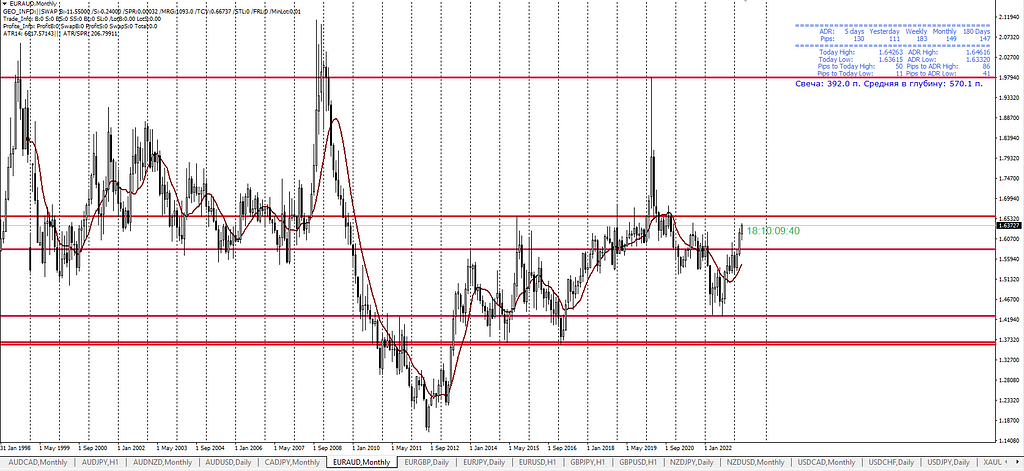

Today we will look at the #EURAUD pair. And as usual, let’s start with the monthly chart. After the emergence of the single European currency, the pair rushed from one extreme of 2.11260 in October 2008 to another 1.16049 in August 2012 for a long time. But relative calm began after the pair entered the range between 1.36 and 1.56 in June 2013 and left it for a period of just over 3 months only once in February 2020. The remaining attempts, mainly to exit above the upper limit of the range, ended in failure and did not last longer than a month, in any case, monthly candles rise only as wicks. There have been 3 such attempts over the past 10 years. Now we see a purposeful movement of the pair to the upper limit of the range, which was formed by the high of August 2015. As you probably already understand, two scenarios are possible here:

- The beginning of a downward movement until the pair approaches the upper limit of the range, where limit orders from sellers will wait for it, which will divert some of the buyers’ liquidity.

- Continuation of the movement upwards, above the upper limit of the range, in order to collect additional counter liquidity from stop orders, which will be there.

Which of the scenarios will be implemented this time, we will only know when there are clear signs of a trend reversal on the chart, so now the most difficult stage is coming, when the pressure of buyers and opposition from sellers will come into play.

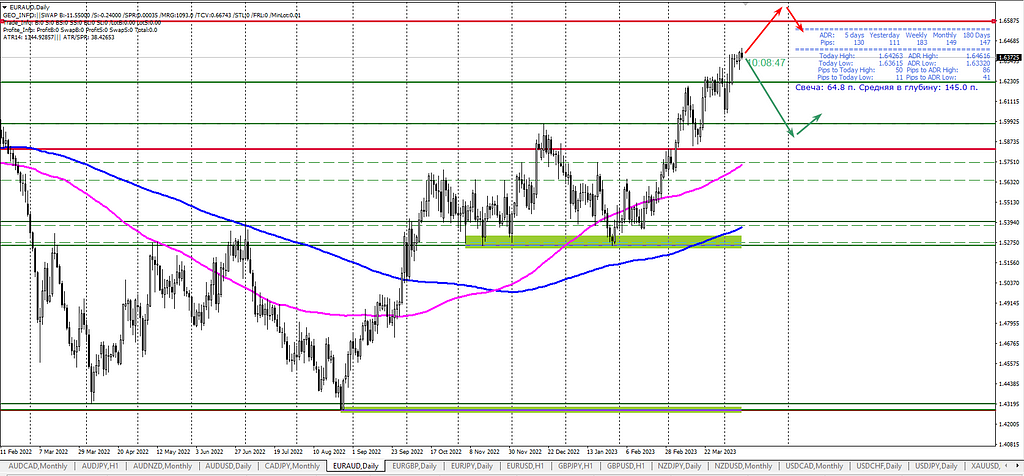

Let’s switch to the daily chart. There is about 2200 pips left to the red line at the top of the chart, which shows the conditional border of the range, this is not a very long distance, so we can expect that the struggle will begin in the coming weeks, if it has not already begun. In favor of the fact that the sellers are entering the fight is evidenced by the gap of the chart up from the average value for 100 days and the relatively low growth rate in recent days. If the previous highs were characterized by a fast strong rise (culmination), then this time we may see a long movement in a narrow range until the sellers get the necessary counter liquidity. It is obvious that some of the major market participants will refrain from opening buy trades, naturally waiting for limit orders to trigger, but the question remains whether the buyers, apparently not the largest ones, will have the strength to raise the price to these limit orders or all the liquidity of the buyers will go to the one who starts first reversal. We will see in the near future how further movement will actually take place.

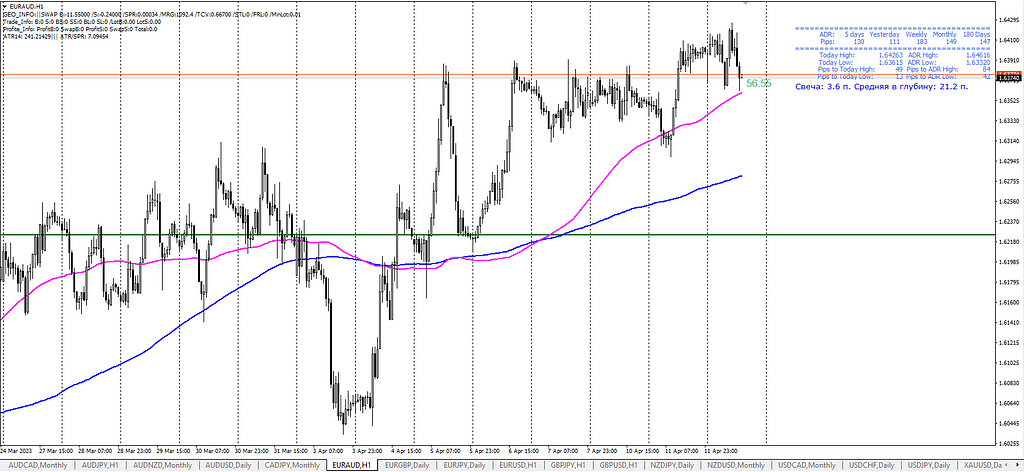

Let’s move on to the hourly chart and try to determine what are the prospects for today’s decline. We see that after last week’s sharp fluctuations, the upward movement has practically stopped. This morning, of course, the pair formed a new high, but it is only 150 pips higher than yesterday, perhaps the forces of buyers are really running out, and sellers began to open deals on April 5? From a formal point of view, the structure of the upward movement was already broken in the last hour, but a new high below the previous one is still missing to complete the picture. But it is also possible that the upward movement will continue after the opening of stock exchanges in North America. Therefore, it is worth waiting a little longer if you intend to start selling, as for buying, they may become more risky, but these are not trading recommendations, but reasoning out loud.

A quick takeoff does not guarantee continued flight… was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link