[ad_1]

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In Nigeria, home of the largest digital asset economy in Africa, a feud has been developing between the government and Binance—a feud that has culminated with one of the company’s executives escaping house arrest and fleeing the country.

Boasting the sixth-largest population in the entire world, the Federal Republic of Nigeria holds a large economic influence over the African continent and a respectable sway in the greater world market. Although the possible future for Nigeria’s economic development has been a topic of great interest for global financial institutions, a particular point of interest is the nation’s apparent affinity for Bitcoin; for example, the country is at the top of nations by relevant Google searches such as “invest in crypto,” etc. Additionally, due to some of the classic reasons like rampant inflation and declining local currency, Nigeria also contains the largest trading volumes in all of Africa. For these reasons, the possible bitcoinization of Nigeria would be a significant boon to Bitcoiners worldwide, and the country may one day be a real hub for the industry.

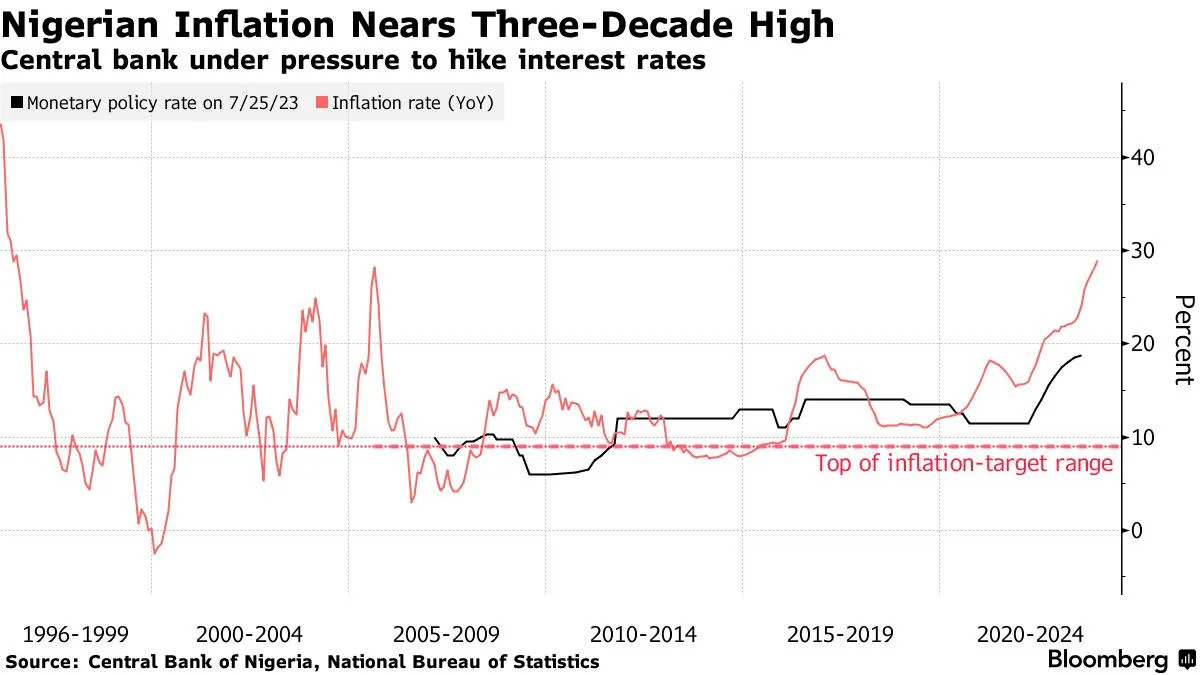

Therefore, Bitcoiners today should certainly be interested in the developing feud concentrated between Binance and the Nigerian government, with special attention to the possibility of a broader crackdown on the industry. The quarrel began in earnest in February 2024, when an alleged “glitch” in Binance’s peer-to-peer (P2P) transaction platform led to deflated prices for users, as government officials formally accused the company of “blatantly setting a special exchange rate for Nigeria” and “trying to manipulate our currency to Ground Zero”. The Central Bank (CBN) considered the widespread usage of P2P Bitcoin transactions as a possible contributor to the naira’s falling performance, and sought to take action against Binance. Considering that inflation in Nigeria is climbing at the fastest rate in decades, this problem seemed especially concerning to authorities.

To this end, a somewhat confusing series of events unfolded: reports circulated in February that the government was blocking services from major exchanges like Binance, Coinbase, and Kraken. Coinbase, for its part, claimed that they had experienced no such troubles with the Nigerian government at the time. The government went on to clarify its position when the CBN singled out Binance, announcing that some $26 billion in “untraceable” funds had apparently passed through the company’s operations in Nigeria. This quantity of cash would represent a significant capital outflow for the entire economy. Additionally, of course, such a large figure certainly reflects a relatively high level of interest and adoption in the broader population. After Binance refused to cooperate with allegations that it had enabled various financial crimes on its platform, the government took the aggressive step of detaining two executives—a British and an American citizen.

This step led to a flurry of activities as the situation between Nigeria and the crypto economy became increasingly muddied. Was the government targeting Binance due to its recalcitrant attitude, or is it only the first step in a planned crackdown on the wider world of Bitcoin? The government shuttered the largest P2P exchange in the nation, but is the practice of P2P Bitcoin trading itself next on the chopping block? Nigerian regulators published an updated list of guidelines for foreign exchanges to follow, and the government additionally entered a new partnership to experiment with the feasibility of rolling out a CBDC, the eNaira. In the United States, the Chamber of Digital Commerce even pressured the White House to intervene in the situation, demanding that the American Binance official be released from custody.

This tense and ambiguous situation came to a head in a very unexpected way when Nadeem Anjarwalla, a dual British-Kenyan national and arrested Binance executive, escaped Nigerian custody with a “smuggled passport” and fled the country on March 25th. Although his family claimed that Anjarwalla’s exit from the country was entirely legal, Nigeria has asked INTERPOL to post an international arrest warrant for him. Apparently, Anjarwalla’s guards allowed him to leave house arrest to visit a nearby mosque and attend worship services, where he disappeared. Not only have the guards been arrested pending an investigation, but the government has also formally charged Binance with tax evasion. Anjarwalla’s American colleague, Tigran Gambaryan, remains in federal custody and has been named as a defendant in the accusations.

These certainly seem like grim portents for the Nigerian Bitcoin space, to be sure. However, the possibility remains that the government is merely attempting to strongarm Binance specifically, as the company has already been swamped with legal problems. In addition to the firm’s troubles in Africa, it has also suffered major setbacks on three separate continents. The most famous of these is the US Department of Justice’s fine: the company must pay $4.3 billion, and CEO Chengpeng Zhao was forced to resign, likely to face prison time. Binance.US was spun off to better accommodate American legal requirements, but even this subsidiary is mired in a series of class-action suits and SEC battles that will probably kill it. It would hardly be the first time, as CommEX, Binance’s successor in Russia after a similar exodus, just closed its doors on March 25th. The company was also blocked in the Philippines the same day, after the government accused Binance of operating without a license.

In other words, the Nigerian government may have simply picked now as the opportune time to strike at a beleaguered rival, one who has long been a target of securities watchdogs in the country. To be sure, there are several worrying signs of a possible Bitcoin crackdown, as a Nigerian court ordered Binance to hand over data on its largest traders, accompanied by rumors that street crypto traders were being targeted by police. The investigation into the eNaira, a possible CBDC to replace the demand for Bitcoin and other digital assets, certainly did not help matters. Nevertheless, there are still plenty of reasons to see a path forward.

For one thing, Paxful’s former CEO and NoOnes’ current CEO, Ray Youssef, was publicly enthusiastic about his company’s chances in Nigeria. Youssef suggested that Nigeria actually raise the registration fees for exchanges to operate in the country, calling the move an invitation to the “big boys” such as Coinbase or his own company operating in the Nigerian market. Youssef went on to state that the government has an interest in restricting these foreign conglomerates from acting as the main venue for P2P sales for fear of capital flight, and exchanges with zero or limited P2P functionality should be welcome to operate normally.

Nigerian consumers have a high preference for P2P as the ideal method for buying and selling Bitcoin, and the possibility that $26 billion can flow from Binance’s P2P market to uncertain locations has shaken the government deeply. Nevertheless, the actual practice of P2P Bitcoin sales is alive and well in the Nigerian market without Binance as an intermediary; for example, International Women’s Day 2024 in Nigeria was marked by large and well-attended seminars focused on educating women from all walks of life on Bitcoin. Focused on demystifying the world of decentralized finance and empowering women, these seminars were sponsored by a wide variety of P2P channels, enthusiasts, and businesses in the Nigerian crypto scene.

From where we’re standing, it seems that the rumors of a broader crackdown on Bitcoin in Nigeria have been greatly exaggerated. Considering that the government’s feud with Binance is rapidly escalating towards an international manhunt, it’s easy to imagine that the government would be making similar attacks on other exchanges like Coinbase or even the Bitcoin world altogether if it had any great interest in doing so. Binance has been perceived as a scofflaw towards Nigerian regulations for some time now, and it seems that their simultaneous legal battles in many jurisdictions have presented an opportunity for Nigeria to join in. The spirit of Bitcoin, however, is alive and well, and Binance’s competitors are more than willing to fill their niche in the market. It’s anyone’s guess as to how robust the Bitcoin industry in Nigeria will be five years from now, as the country’s economy as a whole continues to develop. One thing seems certain, however: It’ll take a lot more than one fight to keep Bitcoin down.

[ad_2]

Source link