[ad_1]

This is a transcribed excerpt of the “Bitcoin Magazine Podcast,” hosted by P and Q. In this episode, they are joined by John Carvalho to talk about building on top of Bitcoin, Bitcoin philosophy and what is happening with the Lightning Network.

Listen To The Episode Here:

Q: Is credit not “fiat” in nature or is there a way to create a healthy credit system through sound money? I feel like this is often debated and discussed and I don’t act or claim to know the right answer to this, I’m just genuinely curious if you feel as though there are components of credit that just make it inherently fiat.

John Carvalho: No, I mean, I think that’s kind of — I’m not trying to be rude or anything, but that’s just a word salad. They have definitions; these things had definitions. To you guys and everybody in the audience, if you want to try to have a tighter grasp of both the dynamics of Bitcoin and the economics that are relevant to it, read “Cryptoeconomics” by Eric Voskuil. There’s no Bitcoiner that understands these things on that level better. My interactions with him and reading with him helped me understand these things a lot more deeply as well.

He would describe Bitcoin as a market fiat. It’s almost like how some people would joke and say it’s a headless Ponzi. There’s no promise that you will get a trade value of bitcoin in the future for any specific amount.

Like bitcoin could be gone and nobody would be accountable. Bitcoin could be the most popular thing on Earth and you could buy a house with something that you only paid $5 for, but there’s no enforcement of the price by anything in the Bitcoin system. The only enforcement in bitcoin is just the quantity of them that you have in the system.

So you don’t know what you’re gonna get for your bitcoin until you try to sell it and it’s all relative to the person you’re selling it to. There’s no enforcement of the price. In a way, bitcoin itself is like a market fiat, a new type of fiat because there’s no controller, there’s no central issuer.

It’s something the market created to be able to have this concept of, and use this abstracted resource as a money. Credit and fiat are just two totally separate concepts. Credit is just simply saying [that] you have people that trust each other. So you have bitcoin for trustlessness. The market fiat, the trustless system, is simply saying, “If I want to have a unit of account where I don’t have to trust anybody to be able to use that, the ultimate store of value in the abstract, you have bitcoin. Everything else is credit.

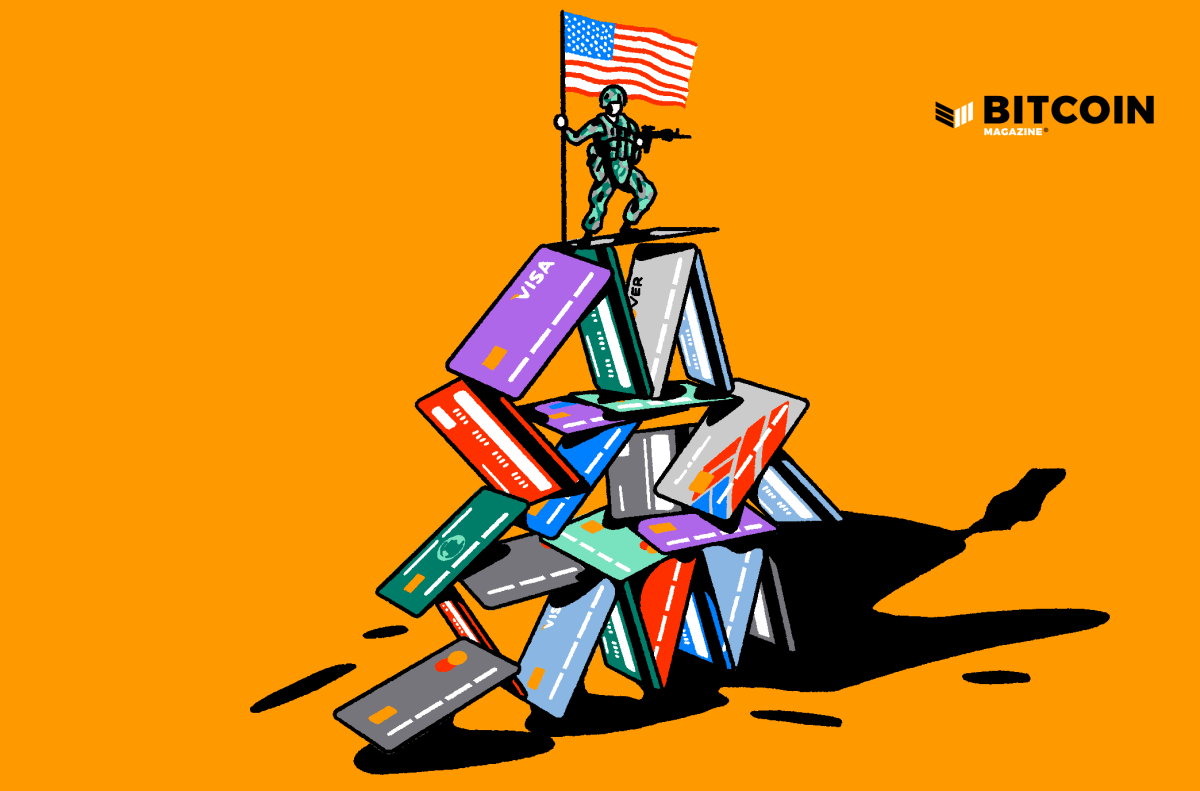

You can say that fiat is a type of credit where they promise nothing. Fiat is just fiat by decree. You’re saying, “This is money.” You have no promise that the issuer will give you something for that money. Unless you wanna get philosophical and say, “Oh, they’re gonna give you an army for that money if you agree to have that money inflated or taken from you at will.” I don’t wanna get philosophical, so we’ll just say there’s no actual promise behind fiat, but credit is a trusted system. It’s acknowledging the fact that two people that trust each other can accomplish more than one person alone.

You can have a kind of singular nature. There’s kind of this dichotomy with humans, you have competition and cooperation. You wouldn’t have society if everybody was competing on everything all the time. When you have cooperation, you have society. Society is trust.

If you want to now cooperate with people over abstractions of economic concepts, you need credit systems. You need to be able to say, “I have one coffee shop. I have proven to my friends P over here that I can run a pretty great coffee shop and I want to have two coffee shops, but my profit margin to open two coffee shops would take me 10 years to open my second coffee shop and I want to open one next year.” And so if he says, “I think John can handle that, I’ll trust John with my money.” Now this is just a form of financing. Credit is like the minimum form of finance. It’s just saying, “I trust you for something in the future.”

I could say, “Ok. I am Starbucks. And I don’t wanna involve P,” I want to say to my customers, “Hey, I’m to sell coffees and I want you to buy them for the future at say a 20% discount.” And now you say, “Well I plan on buying coffees from John or Starbucks for the next five years. That’s a great deal and I’m gonna pre-buy them.” I can now take that and I can leverage that trust and I can use that extra money to open the second coffee shop as long as I can meet my commitments to the redemptions of the coffee.

So you can see how credit is not that much different than finance because you can kind of independently finance things if you take risks on leveraging your credit obligations.

[ad_2]

Source link