[ad_1]

This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Polkadot.

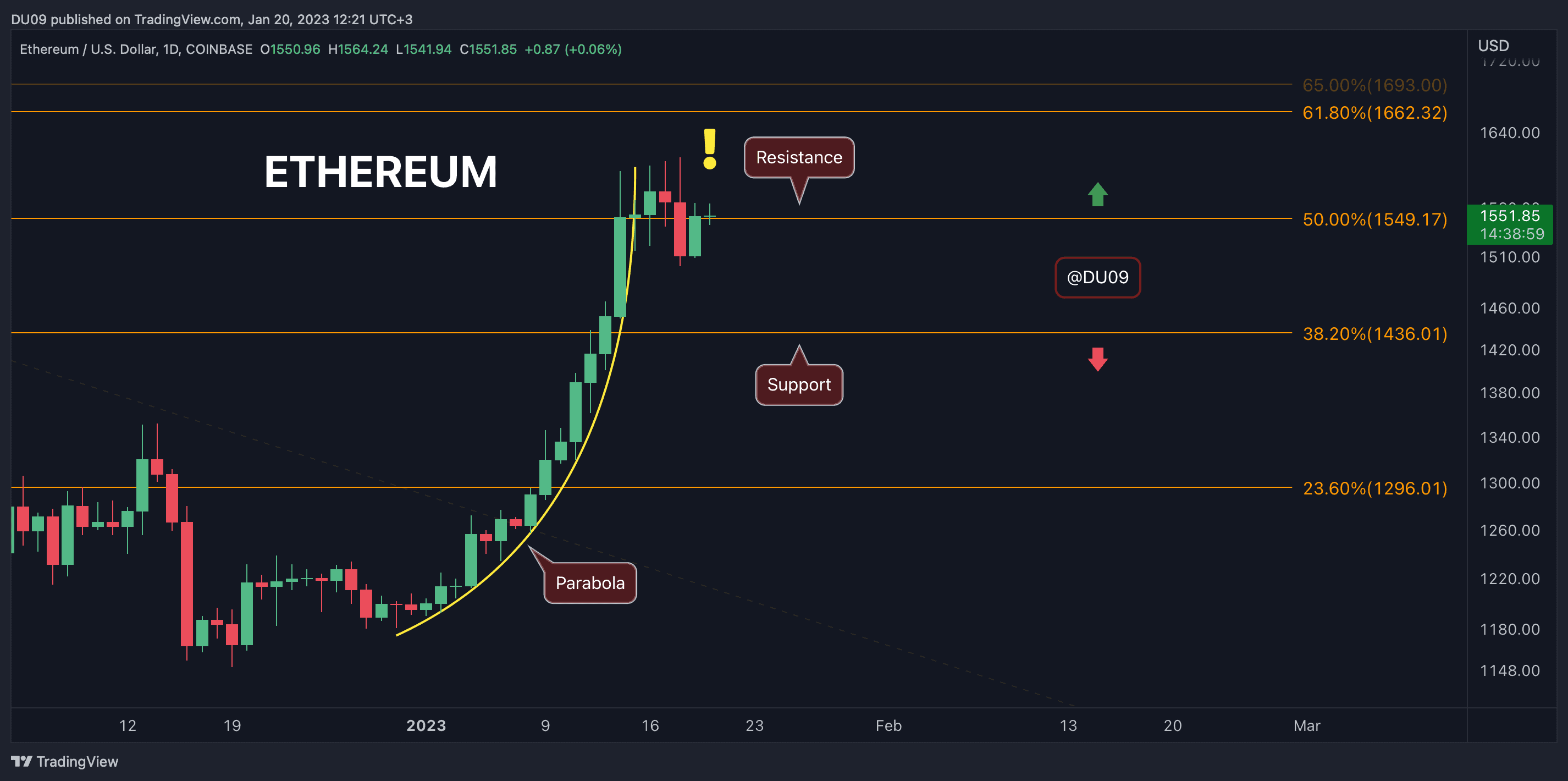

Ethereum (ETH)

Ethereum managed to book a 9.5% increase in the past seven days despite this most recent pullback. However, buyers are now on the defensive because the price broke below the parabola that was formed in early January. This indicates that sellers may soon take over.

Whenever a parabola is broken, that signals a change. In this case, Ethereum managed to reach $1,600 before sellers returned. This key resistance seems likely to hold in the near future since buyers appear to have lost their momentum.

Looking ahead, a retest of the support found at $1,400 seems probable. This would constitute a healthy pullback and an expected move, considering the parabolic increase in the price during most of January.

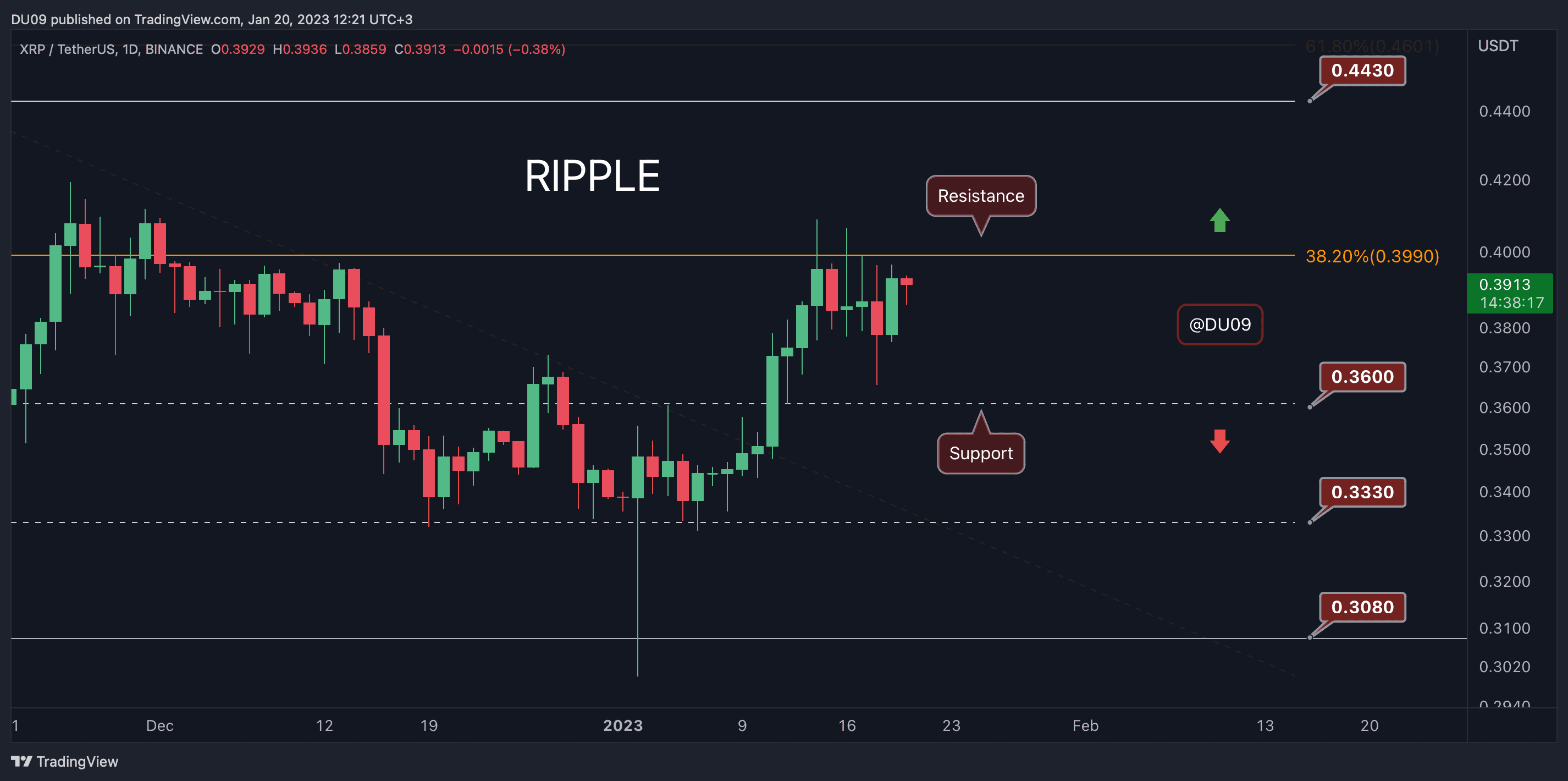

Ripple (XRP)

XRP tried to break above the key resistance at 40 cents but failed. While the price did manage to register a 4% weekly increase, this was not enough to put bulls back in charge. For this reason, the cryptocurrency may hover under the key resistance and consolidate in the near term.

XRP appears to be entering into a flat trend where both bulls and bears trade places in controlling the price action. With good support at 36 cents, it could continue to bounce between the key levels for some time until a decisive breakout.

Looking ahead, the bias for this cryptocurrency leans bullish on higher timeframes (weekly), and this cooldown may be a temporary stop.

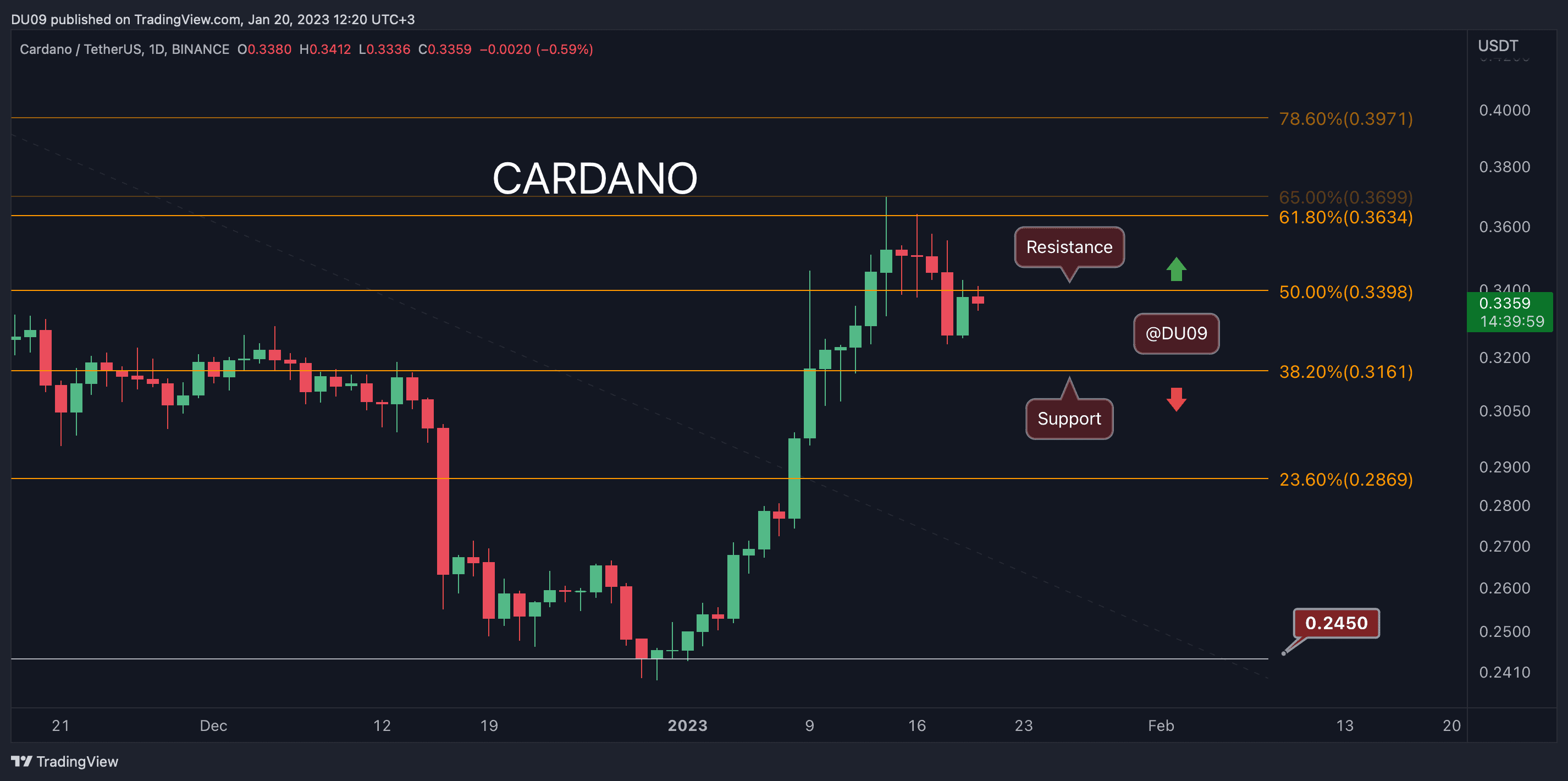

Cardano (ADA)

Cardano’s parabolic rally ended once it hit the 36 cents resistance. This slowed down bulls that only managed a 2.4% price increase in the past week.

The current support is found at 31 cents, and the price may test it before bulls attempt to regain their control over ADA. After such a significant increase, a pullback is normal. The only question is how low can bears take ADA before buying resumes.

Looking ahead, this cryptocurrency seems well-placed to retain most of its recent gains and attempt a continuation toward a higher valuation as long as bulls do an excellent job at defending the key support.

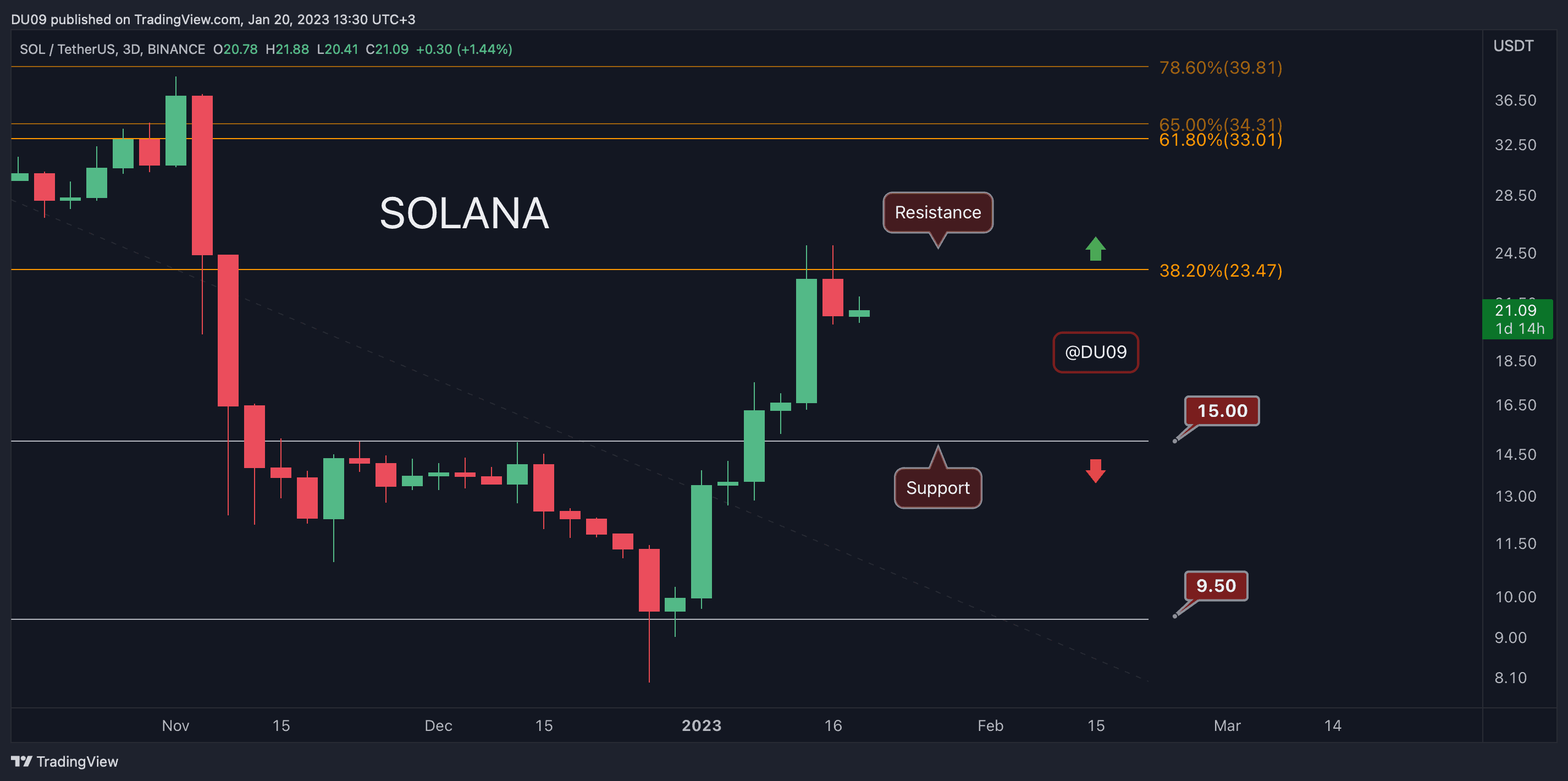

Solana (SOL)

Solana’s rally continued this week and resulted in a 27% increase. This performance makes SOL the top-performing cryptocurrency on our list for the third week in a row. However, the current price action gives signs that the bullish momentum is fading.

Considering the decreasing buy volume, Solana may have trouble sustaining and protecting these most recent gains. With the price rejected at the $25 resistance, sellers may take this opportunity to take SOL into a correction.

The most important levels of support are found at $18 and $15, with the latter having the best chance to stop any significant sell pressure.

Polkadot (DOT)

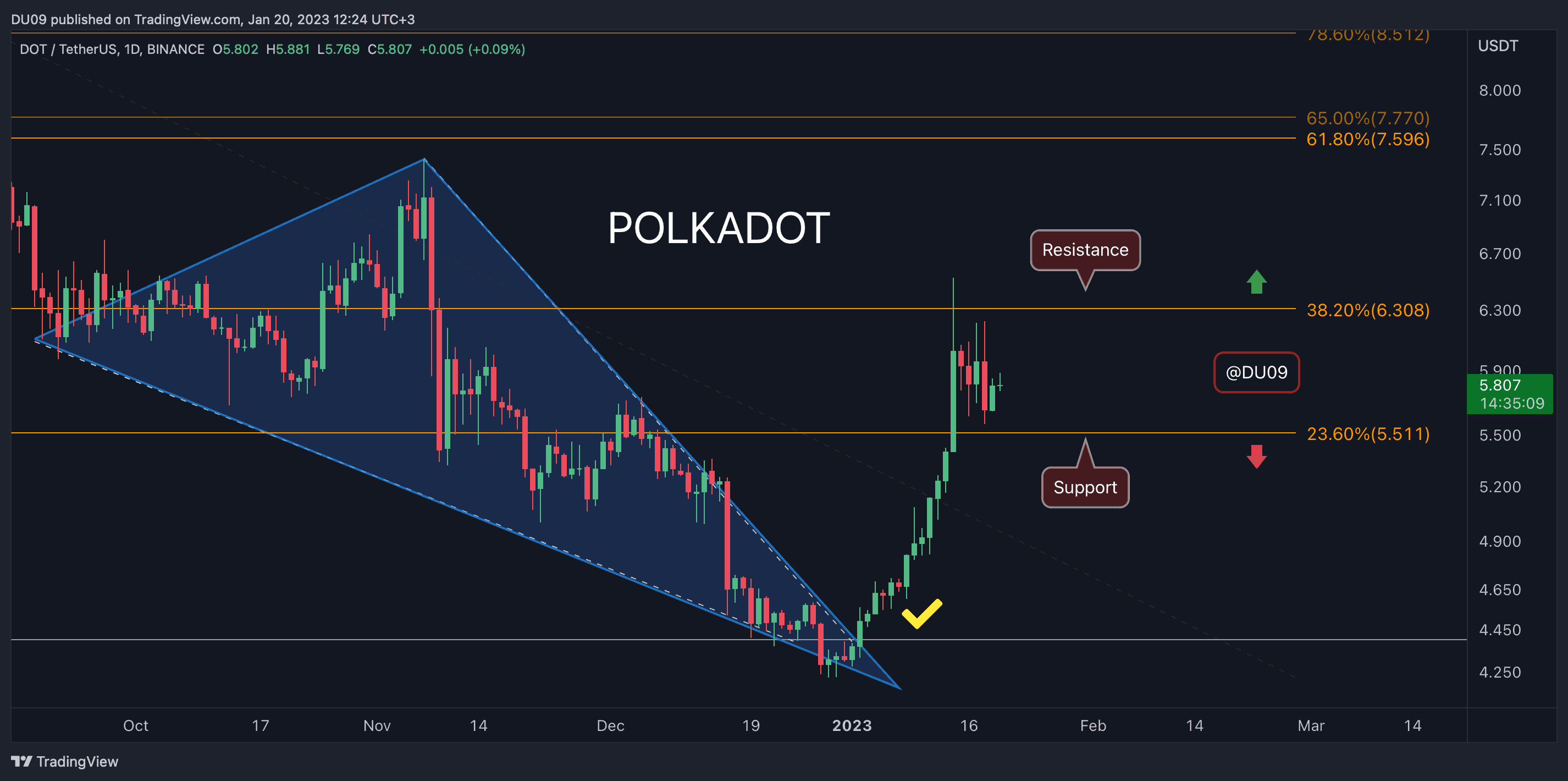

Polkadot also registered an impressive rally in January, booking an 11.3% increase just this past week. Buyers also attempted to break above $6, but bears did not allow it. For this reason, the price was pushed lower and towards the critical support at $5.5.

Since the start of 2023, DOT’s price went from $4 to $6. This was triggered by a breakout from a falling wedge represented in blue on the below chart. Falling wedges are usually a bullish structure, and in this case, the rally played out as expected.

The main challenge for DOT is to hold above $5 and use that as a pivot for a higher valuation later on. Sellers appear keen to stop the price at $6, so bulls will have to regain their strength around the key support level if they hope to continue this rally.

The post Crypto Price Analysis Jan-20: ETH, XRP, ADA, SOL, and DOT appeared first on CryptoPotato.

[ad_2]

Source link