[ad_1]

Bitcoin (BTC) starts a new week on a promising footing with BTC price action near one-month highs — can it last?

In a new year’s boost to bulls, BTC/USD is currently surfing levels not seen since mid-December, with the weekly close providing cause for optimism.

The move precedes a conspicuous macroeconomic week for crypto markets, with the December 2022 Consumer Price Index (CPI) print due from the United States.

Jerome Powell, Chair of the Federal Reserve, will also deliver a speech on the economy, with inflation on everyone’s radar.

Inside the crypto sphere, FTX contagion continues, with Digital Currency Group (DCG) at odds with institutional clients over its handling of solvency problems at subsidiary Genesis Trading.

At the same time, under the hood, Bitcoin still shows signs of recovery from the FTX turmoil, with miners among those catching a break.

Cointelegraph takes a look at these factors and more as the second trading week of January gets underway.

Bitcoin price passes $17,000

Bitcoin managed to spike higher at the Jan. 9 weekly close, hitting levels absent from the chart since Dec. 16.

Data from Cointelegraph Markets Pro and TradingView shows local highs coming in at $17,250 on Bitstamp.

Despite only adding several hundred dollars, the move on BTC/USD did not go unnoticed given the extremely compressed trading range in place for many previous weeks.

Nonetheless, eyeing potential continuation, traders were less than willing to change their longer-term conservative perspective.

“Onwards and upwards to my $17,300 – $17,500 target,” Crypto Tony told Twitter followers in an update on the day:

“I have taken some profit here on my scalp long, and remain in my short as long as we are below 17,500 on 4 hour closure.”

Michaël van de Poppe, founder and CEO of trading firm Eight, likewise left the door open for some modest upside continuation, but warned that the start of the week would present hurdles.

“Still watching a case like this on Bitcoin,” he confirmed alongside an explanatory chart:

“I think we’ll continue rallying coming week, but probably have a drop due to Gemini or correction on Monday first.”

Meanwhile, Venturefounder, a contributing analyst at on-chain analytics platform CryptoQuant, reminded investors to zoom out.

“Bitcoin has been stuck between $16k and $18.5k for 2 months now,” he acknowledged:

“Watch this range very very carefully, a break from either direction can bring 20% volatility, could happen soon. A definitive break of $16k could see $13k, make $18.5k support we can see $22.5k.”

CPI countdown returns as risk asset traders eye volatility

All eyes, including those of the Federal Reserve, are on inflation data this week with the December print of the Consumer Price Index (CPI) due for release.

CPI, which will greet markets on Jan. 12, is a key component of Fed policy, and traders and analysts alike are keenly aware that the signals it provides can lead to shifts in its stance.

Recently, CPI has been declining, hinting that the Fed’s existing interest rate hikes have had a positive impact on inflation.

Should this continue or even decline more than expected, hopes that the Fed will decrease rate hikes faster — or even cancel them altogether — will increase.

This, in turn, provides a window for risk assets including crypto to gain, as Fed policy easing ignites appetite for risk.

“Expecting enormous volatility. Huge cash position and light position size for me,” Ted Zhang, trader and research analyst at Revere Asset Management, told Twitter followers, describing the CPI event as a “huge week.”

Others noted the unusual timing of the CPI schedule, with the data coming two days after a speech on the economy by Fed Chair, Jerome Powell.

“Unfortunately or fortunately the speech is on Tuesday while cpi on Thursday so any hawkishness will be undone post cpi numbers on Thursday!” one response read, adding that market reactions to Powell’s speech may well amount to “noise.”

According to CME Group’s FedWatch Tool, the chances of a 25-basis-point rate hike this month currently stand at 75% versus a 25% chance of a large 50-basis-point move.

Long term, skeptics including “Big Short” investor Michael Burry maintain that inflation will return, with the Fed obliged to raise rates again as a result.

“CPI inflation is unlikely to fall as low as 2%, let alone go negative,” gold bug Peter Schiff wrote in a response to Burry last week:

“But I agree with you that the Fed will return to QE and the official inflation rate will hit a new high. The unofficial actual rate will hit a new all-time record high.”

DCG publicly faces the music

As the fallout from the FTX saga rolls on, it is institutional investment giant Digital Currency Group (DCG) coming in for a grilling this month.

Exposure to FTX heightened pressure on certain DCG subsidiaries in an increasingly complex story which has even raised questions about the future of the largest institutional Bitcoin investment vehicle.

The Grayscale Bitcoin Trust (GBTC) currently has BTC assets under management in excess of $10 billion. Its share price, according to data from Coinglass, trades at an implied 44% discount to the Bitcoin spot price.

As Cointelegraph reported, exchange Gemini has had some of its assets frozen in DCG firm Genesis Trading after it halted withdrawals in light of FTX. Its co-founder, Cameron Winklevoss, has publicly appealed to DCG CEO, Barry Silbert, for answers.

Jan. 8, he wrote in an open letter to Silbert, marking a deadline for the situation to be resolved, but with time up, Silbert himself disputes this.

“DCG delivered to Genesis and your advisors a proposal on December 29th and has not received any response,” he claimed in part of a Twitter response to Winklevoss on Jan. 2.

Should events take an unpredictable turn, the implications for Bitcoin markets may become more serious, with DCG’s prominence as an investment entity making the debacle particularly conspicuous.

Describing recent events, Checkmate, lead on-chain analyst at Glassnode, said that DCG was continuing to “blow up in slow motion.”

“And Bitcoin price is basically a stablecoin,” he added.

“2023 all depends on DCG at this point,” Justin Herberger, author of the Invest and Prosper newsletter, meanwhile forecast:

“If they somehow collapse, it’s gonna get ugly. That could be our last leg down to 85% draw down from Bitcoin ATH’s.”

Miners break severe selling streak

Bitcoin miners have been on the radar for most of 2022, but the BTC price dip which followed the FTX implosion worsened an already tenuous situation.

Miners began to divest themselves of their stored Bitcoin in order to remain financially viable, and on-chain metrics swiftly warned of a miner “capitulation” already in progress.

As Cointelegraph reported, however, neither the extent of the sell-off nor its duration appeared critical, and recently, the situation has stabilized.

“The heavy sell pressure from Bitcoin miners that has barraged the market for the last 4 months has finally subsided for now,” William Clemente, founder of crypto research firm Reflexivity, summarized alongside data from on-chain analytics firm Glassnode this weekend.

That data showed the 30-day net position change for Bitcoin miners, this in fact beginning to increase versus the month prior.

Separate Glassnode data supported the observation, with miners’ BTC reserves hitting their highest in a month on Jan. 8.

Eyeing Bitcoin’s hash rate — the estimated processing power dedicated to mining — Jan Wuestenfeld, analyst at crypto research and advisory firm Quantum Economics, was equally upbeat on the status quo.

“It is crazy how the hashrate, albeit miners coming under heavy pressure, has only corrected a bit over the last two months of 2022 and now is even increasing considering the 30-day moving average,” he noted.

Last week, Bitcoin’s network difficulty adjusted downward by around 3.6%, taking into account a drop in competition among active miners. According to the latest forecast from BTC.com, however, the next adjustment will wipe out those losses to add 9% to the difficulty level, in so doing marking a fresh all-time high.

“Extreme fear” meets 18-month crypto volume lows

Crypto market sentiment is as unsure as ever when it comes to the near-term outlook, according to the Crypto Fear & Greed Index.

Related: Macroeconomic data points toward intensifying pain for crypto investors in 2023

Over the weekend, the Index, which compiles a sentiment score from a basket of weighted triggers, dipped back into the top of its most bearish bracket, “extreme fear.”

A first for 2023, “extreme fear” is nonetheless familiar to longtime market participants, who watched as sentiment endured its longest-ever stint in the Index’s lowest zone last year.

At the same time, interaction with crypto appears noticeably lacking at current price levels.

Data from research firm Santiment has captured the lowest transaction volume across crypto since mid-2020.

“Altcoin volume is particularly low,” a note to an accompanying chart stated.

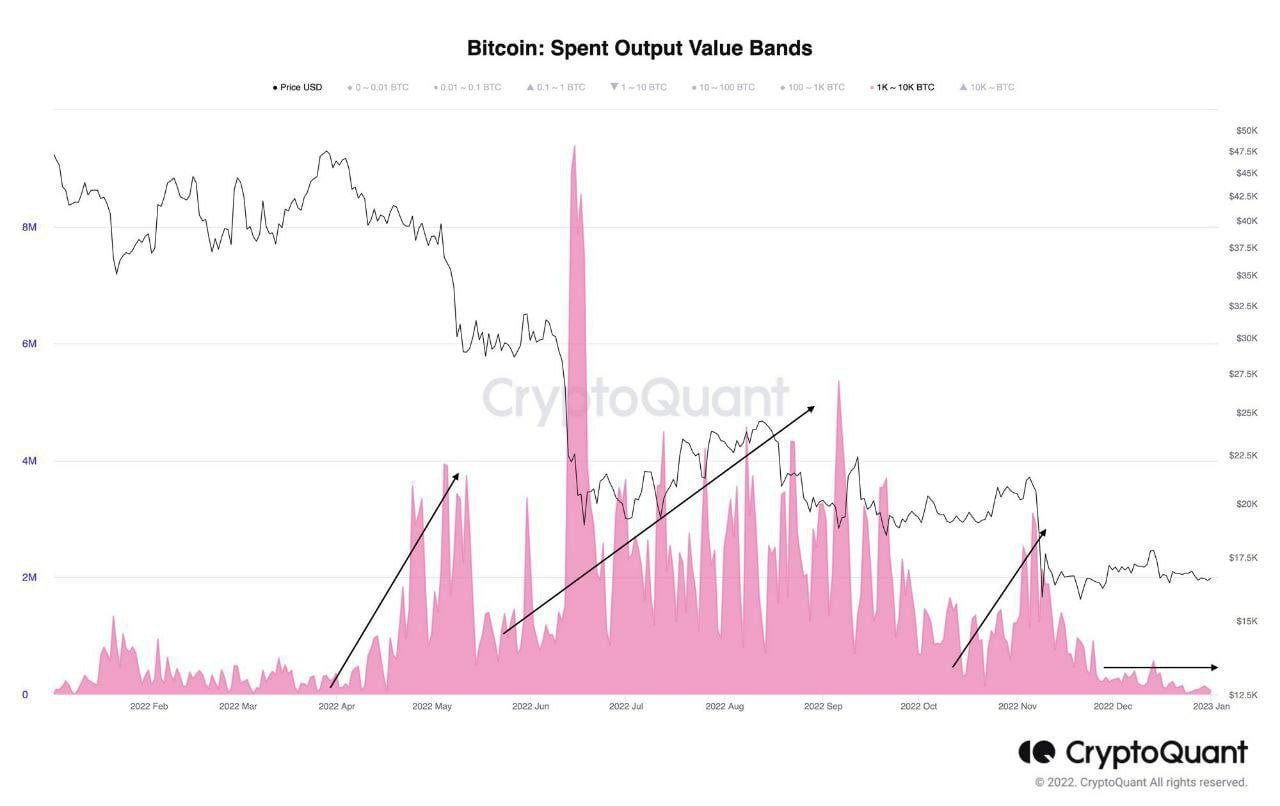

Separate numbers from CryptoQuant flagged by popular social media commentator CryptoBitcoinChris nonetheless noted that whale selling had also decreased since December, this potentially setting a trend and “positive effect on market sentiment.”

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

[ad_2]

Source link