[ad_1]

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transitioning to the Finance Corps.

2022 started with a bang, especially in Canada. Whether or not you agree with the premise behind the Canadian Trucker Protest, I think most can agree that freedom of speech is a keystone right in modern Western Democracies.

But when the Canadian government began to crack down on protestors by freezing bank accounts, people turned to Bitcoin to help them survive. Organizations like GoFundMe not only blocked the protestors from receiving the money that had been raised, but they even attempted to pass the money along to causes that they aligned with. After some uproar, GoFundMe ended up refunding the money, but the message was clear: comply.

However, Bitcoin allowed truckers to skirt these restrictions.

Above is a snippet from an article from the Motley Fool, written in March 2022. Though I don’t agree with its conclusion or reasoning, the fact that traditional outlets were asking questions like that was a massive signal that perhaps the normies are starting to catch on.

More recently, the Iranian government announced that it would be freezing the bank accounts of women who refuse to wear hijabs, traditional Muslim head covering, in public. This came after the threat of imprisonments and executions in order to quell ongoing protests for the freedom of expression there. As of December 8, 2022, one protester had already been executed by hanging by the Iranian government.

The fact is, nobody is going to save you. Ethereum insists on being the new decentralized money of the internet, and yet, the protocol is enforcing Office of Foreign Asset Control (OFAC) sanctions on its base layer. It’s becoming pretty clear that Bitcoin is perhaps the only easily-transportable freedom money left. I think this distinction became all the more clear as 2022 continued.

The Altcoin Bonanza Goes Down in Flames

“The same technology that allows for peer-to-peer money has allowed for peer-to-peer scams.”

From Celsius, to Three Arrows Capital, Luna, FTX, BlockFi, Voyager, and even Gemini, companies that deal in altcoins all felt pain in one form or another — Leverage, rehypothecation, algorithmic Ponzi schemes and the like. It seems to be that the biggest use case for crypto is making a quick buck at the expense of others, while rug pulling normies as your exit liquidity. It’s like the 1990s tech boom all over again.

One of the most interesting parts of this whole debacle were the accusations of a lack of bitcoin held at FTX after its balance sheet was revealed in bankruptcy filings. Whether or not the accusations are true, the fact that it’s a legitimate question is illuminating. It appears to have sparked a fire. I think, slowly but surely, people are starting to see the difference and realize that Bitcoin and crypto really aren’t the same things after all.

The Turning Point Of 2023

Bitcoin has differentiated itself not only from the traditional banking system in a meaningful way, but from crypto as well.

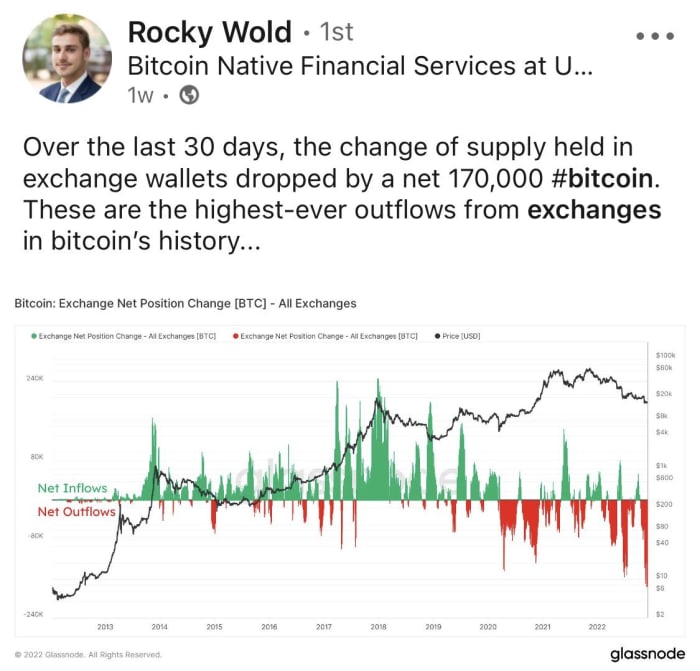

The FTX debacle has highlighted the necessity for self custody: that your coins may not actually exist and the only way to find out if they’re real is to take custody. Bitcoin is now leaving exchanges in droves.

Rocky Wold on LinkedIn, accessed December 2022

Could this be a turning point for Bitcoin? Could people be waking up to the importance of self custody en masse? Only time will tell. I am optimistic that this trend will continue, taking the power from centralized exchanges and their ability to enforce censorship on behalf of hostile regimes. As far as I’m concerned, the more bitcoin in self custody, the better.

If you’re still hesitant to take self custody I recommend watching some BTC Sessions demonstrations. It’s really not that difficult and the peace of mind is priceless. I nearly lost everything earlier this year when Celsius blew up. Don’t be like me. Stop procrastinating and take possession of your bitcoin today. Only then will you truly understand why and how it’s different.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link